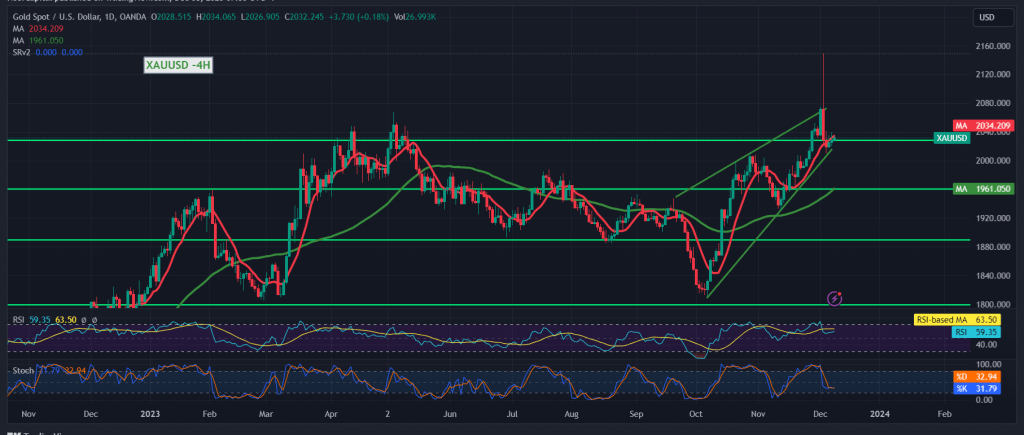

The technical outlook remains unchanged, and gold prices maintain negative stability. We did not witness major movements during the previous trading session, so the price stabilized momentarily below the 2035 resistance level, and most importantly 2040.

Technically, today, by looking at the 4-period chart, we find that the simple moving averages continue to cross negatively and are still pressuring the price from above, and this comes in conjunction with the appearance of negative signals on the Stochastic indicator. It should be noted that the price tried to benefit from the 2009 support level.

In our trading, we tend towards negativity, knowing that sneaking below 2016 facilitates the task required to visit 2007 and then 2000 as an initial station, while keeping in mind that confirmation of breaking the psychological barrier of 2000 may put the price under strong negative pressure, with the target being 1992.

As a reminder, crossing upwards and consolidating the price for at least an hourly candle above 2040 will immediately stop the downward tendency, and we wait for an ounce of gold around 2049 and 2059, and the gains may extend towards 2073.

Warning: Today we are awaiting high-impact economic data issued by the American economy “NFP, average wages, unemployment rates” and we may witness high price fluctuation at the time of the news release.

Warning: The risk level is high and we may witness random movements in which the expected return does not match the risk.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations