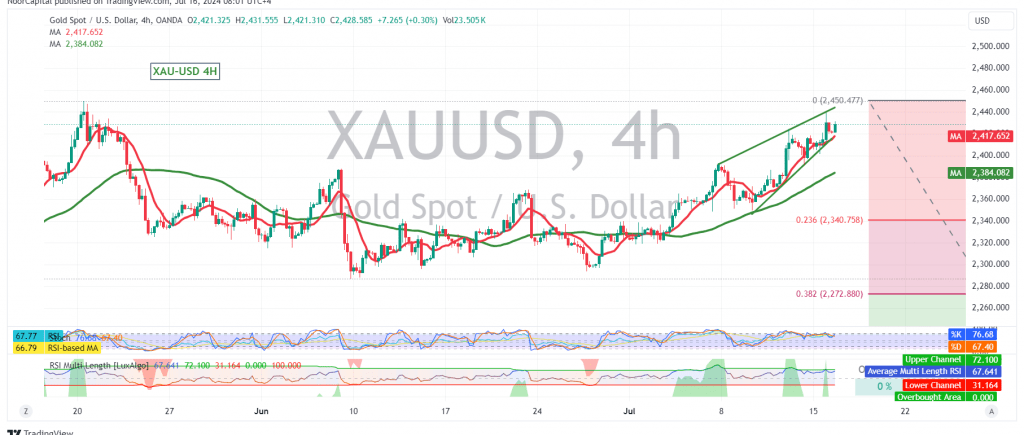

Gold prices maintain their upward momentum, successfully consolidating above the key psychological level of 2400 and reaching a high of $2439 per ounce, surpassing our previous target of 2434.

Technical Outlook:

The technical outlook remains strongly bullish. The price is holding above the 2400 support level, and the simple moving averages (SMAs) continue to provide positive support for the upward price movement. Additionally, the Stochastic oscillator is showing signs of overcoming recent negative divergence, further supporting the bullish bias.

Upward Potential:

With the current bullish momentum and strong support, we expect the upward trend to persist. The primary target is now the previous peak around 2450/2445, a crucial level for the medium-term trend. A break above this level could significantly accelerate the rally, potentially leading to 2460 and 2480.

Downside Risks:

However, traders should remain cautious as a return of trading stability below 2393 could postpone the upward movement and trigger a temporary correction, targeting 2384 and 2368.

Key Levels:

- Support: 2400, 2393, 2384, 2368

- Resistance: 2445/2450, 2460, 2480

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations