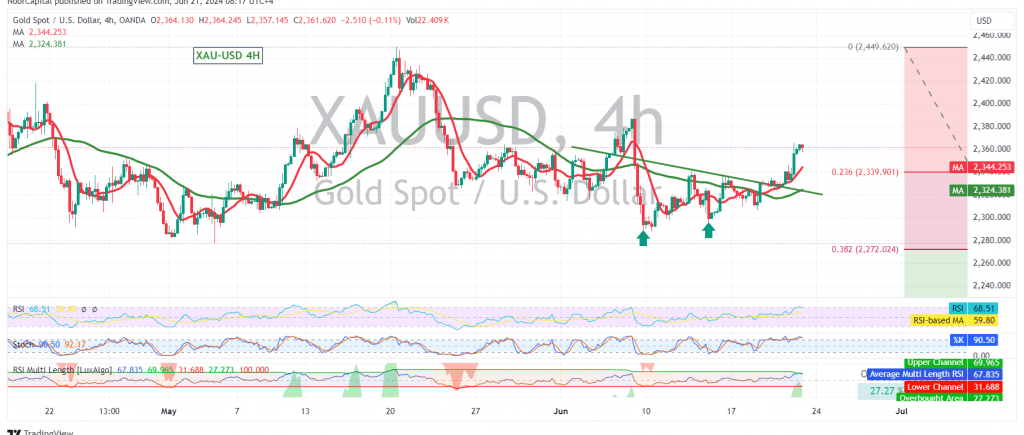

Gold prices reversed their previous downward trend and rallied during yesterday’s trading session, surpassing the key resistance level of 2340 and reaching a high of $2365 per ounce. This price action indicates a potential shift in sentiment towards a bullish outlook.

Technical Outlook:

The technical analysis now suggests a continuation of the upward momentum. The price has successfully breached and is holding above the pivotal 2340 resistance level, which now acts as a support. The simple moving averages have also turned supportive, further strengthening the bullish bias.

Upward Potential:

With the current bullish momentum and the price holding above 2340, our primary target is 2375. A consolidation above this level could open the door for further gains towards 2389.

Downside Risks:

However, traders should remain cautious as a return of trading stability below 2340, particularly a break below the 23.60% Fibonacci retracement level of 2337, could invalidate the bullish scenario. This could lead to a resumption of the bearish trend, with potential targets at 2313 and 2300.

Key Levels:

- Support: 2340, 2337, 2313, 2300

- Resistance: 2375, 2389

Important Note:

The release of high-impact economic data today, including the services and manufacturing PMI indices from major economies, could trigger significant price volatility. Traders should exercise caution and closely monitor the market’s reaction to these data releases.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations