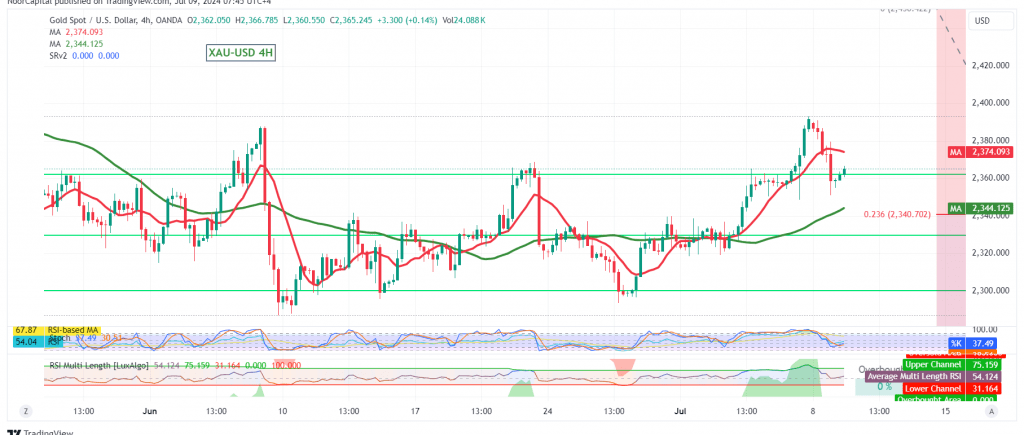

In our previous report, we highlighted potential targets of 2374 and 2388 for gold, which successfully reached a high of $2391 per ounce. While a minor pullback occurred due to overbought conditions, the technical outlook remains bullish.

Key Technical Signals:

- Support Holds: The 2353 support level effectively limited the recent bearish pullback.

- Upward Rebound: The 4-hour chart shows an early upward rebound, supported by the positive influence of the 50-day simple moving average.

- Breached Resistance: The previous resistance at 2340, representing the 23.60% Fibonacci retracement, has been broken and is now acting as support, further solidifying the bullish bias.

Upward Potential:

As long as trading remains above 2340, the upward trend is likely to persist. A break above 2364 would further strengthen this bias, potentially propelling gold towards 2374, 2388, and possibly even 2400.

Downside Risks:

Should the price fail to hold above 2340 and consolidate below this level, the bullish scenario could be invalidated. In this case, a downward correction might ensue, targeting 2329. A break below 2329 would signal a more significant correction, with a potential target of 2318.

Caution:

- High-Impact Economic Data: Today’s release of high-impact economic data from the US, including testimony from Fed Chairman Jerome Powell and a speech by the US Treasury Secretary, could introduce substantial volatility into the market.

- Geopolitical Tensions: Ongoing geopolitical tensions also contribute to the risk of heightened price fluctuations.

Overall Assessment:

Despite the recent pullback, the technical outlook for gold remains bullish. Key support levels are holding, and an upward rebound is underway. However, traders should exercise caution due to the potential for volatility stemming from both economic data releases and geopolitical events. A break above 2364 would confirm the continuation of the upward trend, while a failure to hold above 2340 could trigger a downward correction.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations