The yellow metal achieved noticeable gains yesterday, nullifying the negative outlook as we expected. We relied on the trading stability below the 1770/1768 resistance level, touching the stop-loss order at 1770. We mentioned that any attempts to breach 1770 would cancel the bearish scenario immediately and lead Gold to achieve gains around 1780, recording a high of 1796, compensating for part of the losses of the short position.

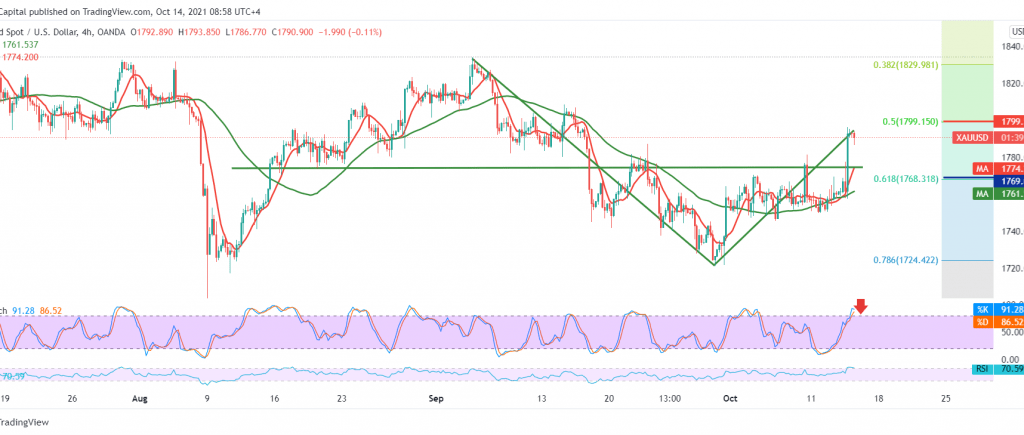

Technically, and carefully looking at the 4-hour chart, we notice the conflict between the technical signals between the stochastic indicator reaching the overbought areas, which increases the possibility of a decline, in addition to the gold price hitting the 1799 resistance level, 50.0% correction. The positive motive The 50-day moving average and confirming the breach of 1768 are technical factors that support the possibility of continuing the rise.

From here, we prefer to remain neutral until we determine the trend more accurately, waiting for one of the following scenarios:

Confirming the resumption of the rise requires a clear and robust breach of the 1799 resistance level, 50.0% correction, which can reinforce gold gains to visit 1805 and 1815, respectively.

Reactivating the selling positions requires breaking the previously breached resistance, which is now converted to the 1768 support level, 61.80% correction, and stability below it. From here, Gold returns to the downside trend towards 1742 and 1735.

CAUTION: The risk level is high.

| S1: 1766.00 | R1: 1805.00 |

| S2: 1742.00 | R2: 1820.00 |

| S3: 1727.00 | R3: 1844.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations