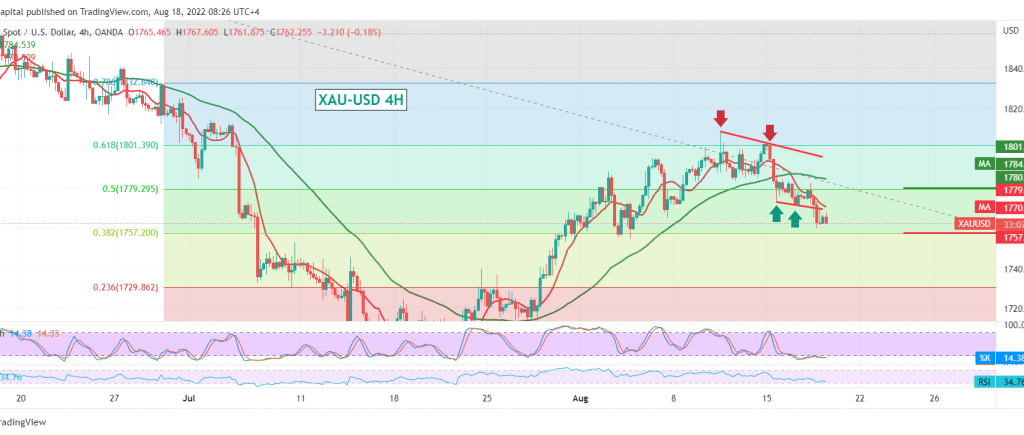

We adhered to neutrality during the previous report due to the conflict of technical signals, explaining that activating the short positions requires breaking 1771, which puts the price of gold under negative pressure, its initial target 1756, to lead the price within the expected path, approaching by a few points, at the required target, recorded 1759.

On the technical side, the price of gold confirmed breaking the 1779 level located at 50.0% Fibonacci correction, as shown on the chart, and that increases the possibility of a price decline, in addition to the negative crossover of the simple moving averages that returned to pressure the price from below.

Therefore, the bearish scenario remains valid towards the required target of the previous report, 1758, and then 1753. However, it should be noted that breaking the latter increases and accelerates the strength of the bearish tendency, so we will be waiting for an ounce of gold around 1740, unless we witness any trading and stability above 1779, the previously broken support, which is now converted into a resistance level. .

Consolidation above 1799 leads the gold price to recover, and we target 1790 initially.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations