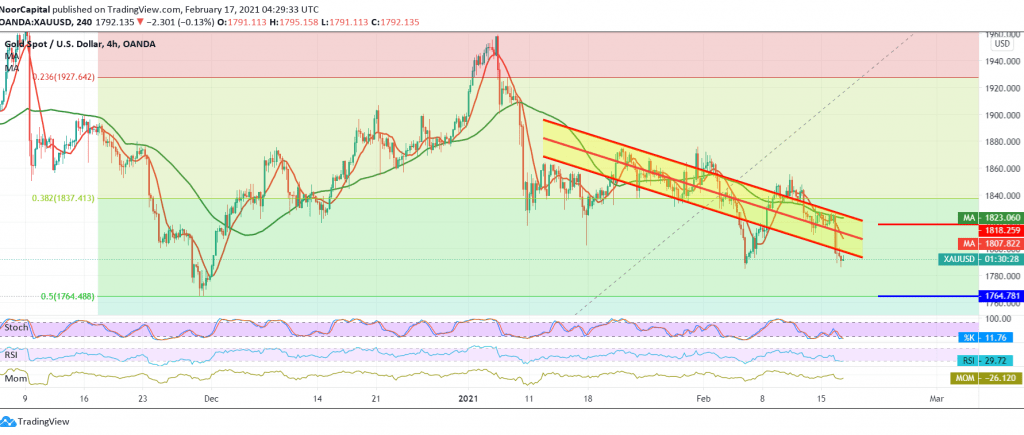

The yellow metal suffered heavy losses during the previous trading session, after it succeeded in breaking the pivotal support level indicated during the previous analysis, 1810, indicating that trading below 1810 makes the bearish tendency impose its control again to target 1801 and losses may extend later towards 1792, to reach its lowest level at 1786. .

Technical indicating the possibility of continuing the decline, and with a closer look at the chart, we notice the negative pressure of the simple moving averages, and this coincides with the negative signals coming from the RSI.

From here, with intraday trading below 1810 and in general below 1817, the bearish scenario remains valid and effective targeting 1777, and then 1764 50.0% Fibonacci retracement.

Any trading above 1820 is capable of stopping the negative moves, and we may witness a bullish path again with initial target around 1841.

| S1: 1777.00 | R1: 1817.00 |

| S2: 1761.00 | R2: 1841.00 |

| S3: 1737.00 | R3: 1857.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations