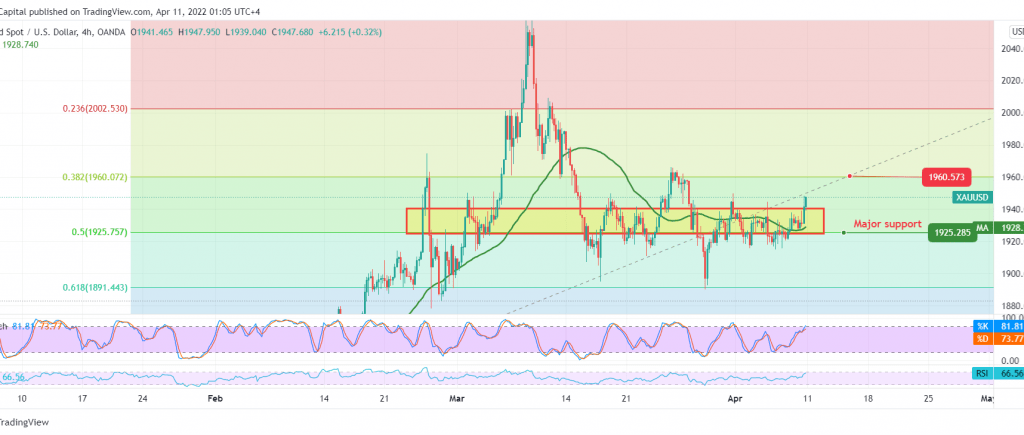

After several consecutive sessions of our commitment to neutrality, waiting for the gold price to exit the sideways range between 1925 and 1940, explaining that activating purchase orders depends on gold’s ability to penetrate 1940 to target 1948, recording its highest price last Friday’s transactions 1948.

From the angle of technical analysis today, and with careful consideration of the 4-hour chart, we notice the return of gold prices to stability above the pivotal demand level 1925, 50.0% Fibonacci correction, in addition to the intraday stability above 1940, which is counted by the positive motive of the 50-day simple moving average.

Therefore, there may be a possibility of an upward trend that targets 1956, the first target, and extends to visit 1960, 38.20% correction, the next official station on which the next price destination depends, as long as the price is stable above 1928 and most importantly 1925.

The decline again below the pivotal support floor of 1925 renews the chances of returning to the bearish tendency, so we will wait for 1910 in principle.

Note: The risk level is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations