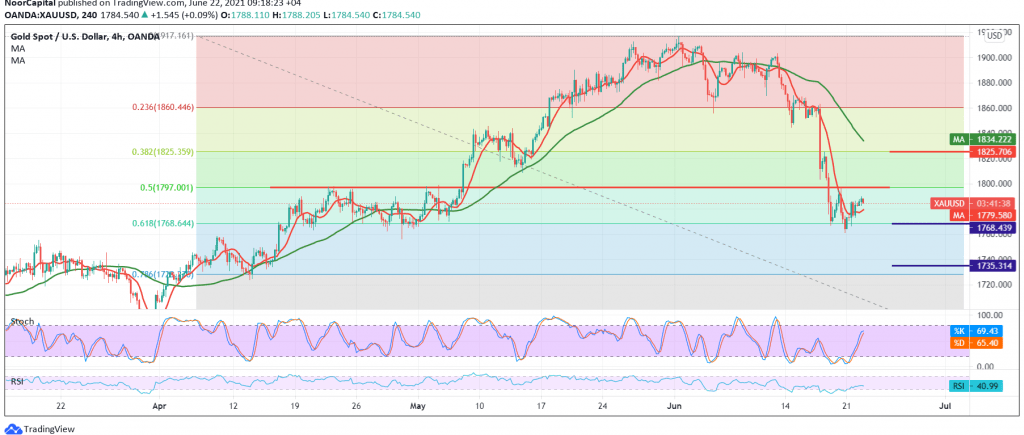

Positive trades dominated the gold price movements during the previous trading session, within a limited upward bias to retest the 1790 resistance level.

On the technical side today, looking at the 60-minute chart, we find that the RSI is trying to get positive signs to get bullish momentum.

On the other hand, we find the 50-day moving average that continues to pressure the price from above, accompanied by the clear negative signs on stochastic.

Therefore, the bearish bias is the most preferred during the day, as long as trading remains below 1797 represented by 50.0% Fibonacci correction, targeting 1770/1769, a first target, taking into consideration that breaking the first target level facilitates the task required to visit the official target of the current downside wave around 1735.

From above, trading above 1797/1800 is able to completely thwart the bearish scenario, and gold will regain the bullish path with an initial target of 1820.

Note: The risk level may be high.

| S1: 1769.00 | R1: 1787.00 |

| S2: 1753.00 | R2: 1810.00 |

| S3: 1743.00 | R3: 1823.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations