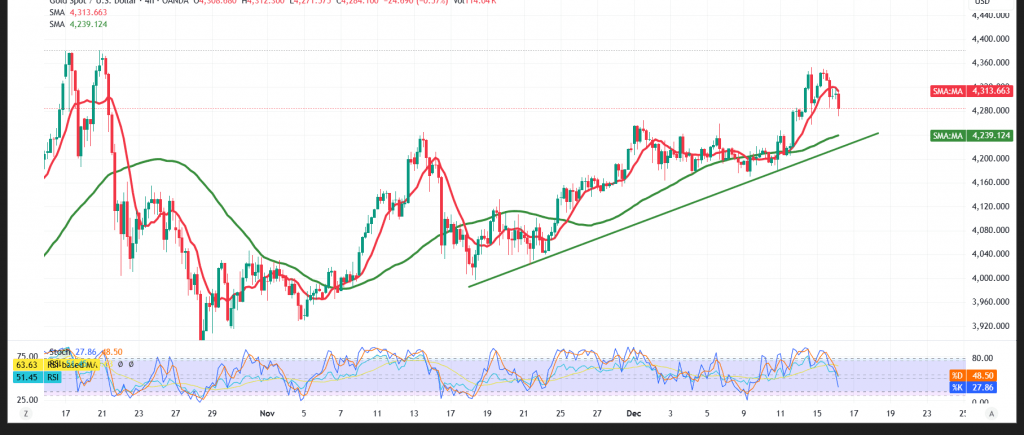

Mixed movements continue to dominate XAU/USD within a short-term upward trend.

Technical Outlook – 4-Hour Timeframe:

Intraday price action shows a downward bias due to trading below the 4300 resistance level, while the Relative Strength Index (RSI) is working to ease overbought conditions. At the same time, the 50-day Simple Moving Average (SMA) continues to provide positive momentum and acts as a strong support level.

Given the conflicting technical signals, it is preferable to monitor price action to determine one of the following scenarios:

A confirmed break below the 4270 support level could accelerate declines, initially targeting 4250 and potentially extending to 4215. On the other hand, a renewed move above 4300 could allow prices to resume their upward path toward 4330, with further gains possible near 4375.

Caution: The risk level of trading gold is relatively high and may not be suitable for all investors.

Alert: Today we await high-impact US economic data, including non-farm payrolls, average earnings, unemployment rates, and preliminary services and manufacturing PMI readings. Significant price volatility is likely around the time of release.

Alert: The risk level remains high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4250.00 | R1: 4330.00 |

| S2: 4221.00 | R2: 4379.00 |

| S3: 4171.00 | R3: 4408.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations