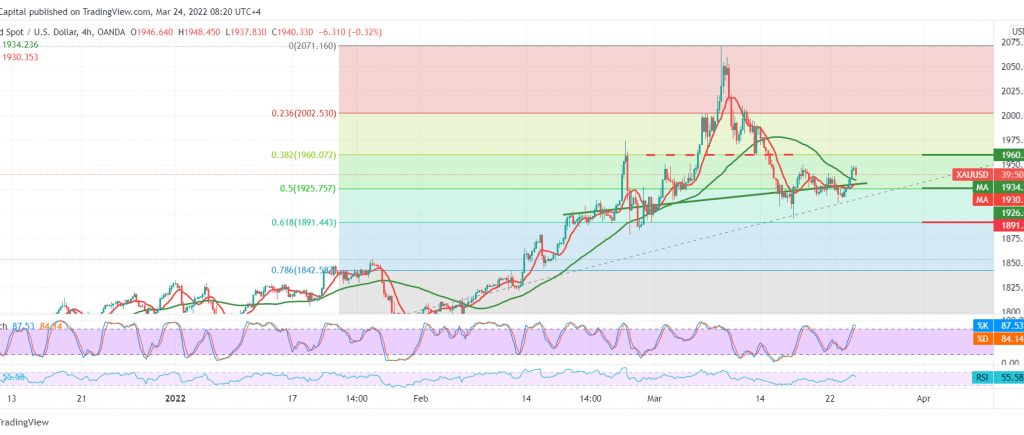

We adhered to intraday neutrality during the technical report yesterday due to the conflicting technical signals, explaining that we are waiting to confirm the break of 1925 or 1942, so that gold prices will witness a bullish tendency after it succeeded in attacking the 1942 resistance approaching the first target 1951, recording its highest level at 1949.00.

On the technical side today, and by looking at the 4-hour chart, we notice the stability of trading remarkably above the pivotal support floor 1925 represented by the 50.0% Fibonacci correction, and we notice the 50-day moving average that started to provide a positive incentive in support of the possibility of resuming the ascent.

Therefore, the possibility of touching 1953 as a first target is a valid possibility, taking into consideration that the breach of the mentioned level is able to enhance the chances of touching 1960, a correction of 38.20%.

The infiltration below 1925 may be able to thwart the bullish scenario and renew the chances of negative pressure on gold prices to be the awaited stop at 1891, 61.80% correction. Warning: Stochastic is trying to get rid of the current negativity.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations