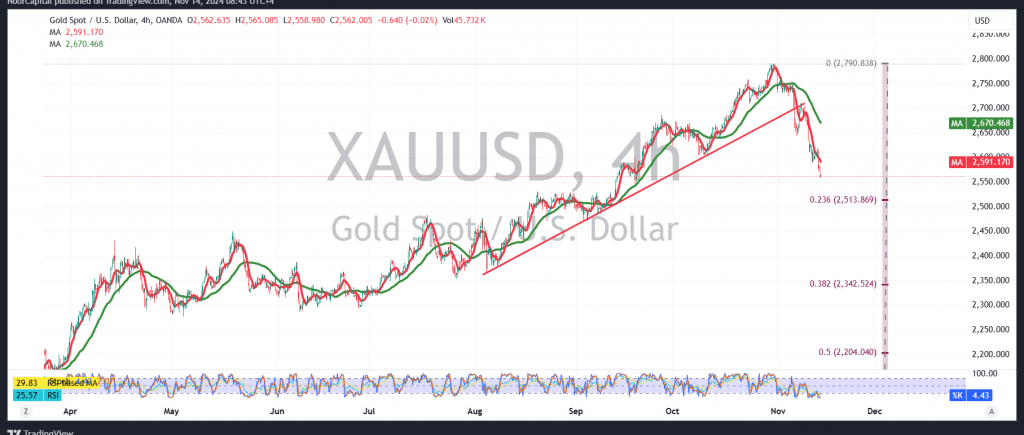

Gold prices have continued their significant decline, reversing the upward correction scenario outlined in our previous technical report. This analysis had emphasized that maintaining stability above the support line of the ascending channel was crucial. The breach below the 2600 level, however, has led gold prices to resume their downward trend, with the metal reaching a low of $2558 per ounce during early trading.

From a technical standpoint, gold has decisively broken below the upward trend line, and the simple moving averages remain positioned to support further downside movement.

Consequently, a confirmed break of 2558 would extend the losses, setting the stage for initial targets at 2547 and 2540. If selling pressure persists, the decline may stretch further to 2519.

However, any recovery would require gold to climb back above 2600. Sustaining this level could trigger a rebound, with upward targets beginning at 2618 and 2630, and potentially extending to 2639.

Caution: The risk environment remains elevated.

Risk Alert: The release of critical US economic data, including the “Producer Price Index – Annual, Producer Price Index – Monthly, and Weekly Unemployment Claims,” could lead to heightened price volatility.

Geopolitical Risk Warning: The ongoing geopolitical uncertainties contribute to a high-risk atmosphere, and various outcomes remain plausible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations