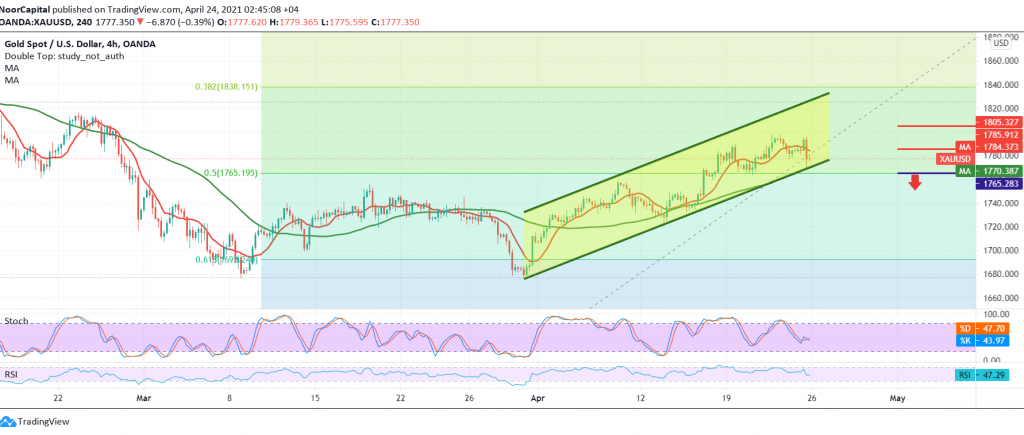

We committed to the intraday neutrality in the previous analysis due to the conflict of technical signals, mentioning that the selling positions requires stability below 1795, also need to witness a break of 1777, in order to reach 1765, so that gold is subjected to slight selling operations and is satisfied with recording its lowest level 1770.

Technically, with a closer look at the 60-minute chart, we find the RSI setteled below the 50 middle line in support of the bearish bias, in addition to the negativity that began to appear on the stochastic indicator.

We tend to be negative, as long as trading remains below 1770, with a breakout confirmation, which makes it easier to re-test 1765, 50.0% correction. It should also be noted that confirming a break of the aforementioned level places the price under negative pressure, its second target is around 1756.

Skip up and rise again above 1783 and more importantly, 1795 is able to completely negate the bearish scenario and recover gold again, so that the way is open towards 1808 and the gains extend later to the visit 1817.

| S1: 1766.00 | R1: 1792.00 |

| S2: 1756.00 | R2: 1807.00 |

| S3: 1740.00 | R3: 1818.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations