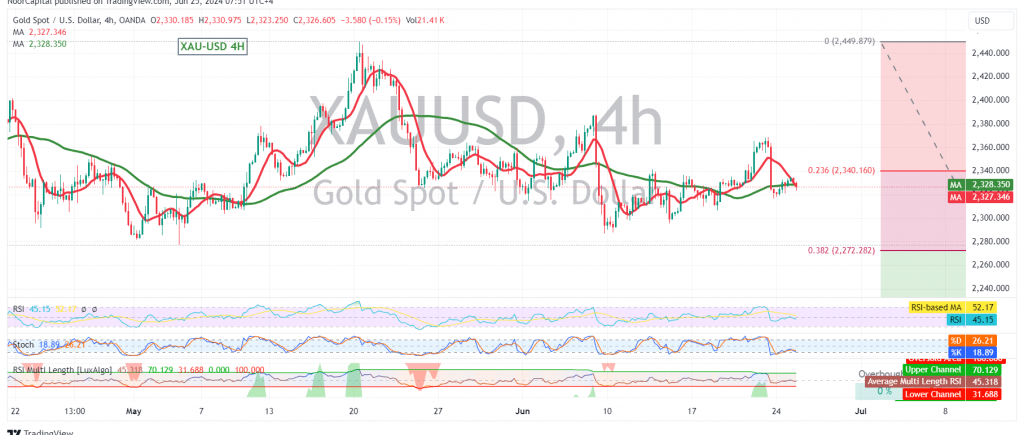

Gold prices have been trading within a narrow range, bounded by the 2317 support and 2340 resistance levels during the start of the week.

Technical Outlook:

Our technical analysis suggests a potential continuation of the downward trend. This bearish outlook is supported by the price remaining below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart, coupled with the price trading below the 50-day simple moving average.

Downside Targets:

A break below the 2317 support level would likely trigger a resumption of the downward correction, with potential targets at 2300 and 2272.

Potential Reversal:

However, a return of trading stability above the 2340 resistance level and a successful consolidation could invalidate the bearish scenario. In this case, the price could turn higher, initially targeting 2345 and potentially extending towards 2357.

Key Levels:

- Resistance: 2340, 2345, 2357

- Support: 2317, 2300, 2272

Important Note:

The release of the U.S. Consumer Confidence Index today could significantly impact gold prices. Traders should exercise caution and closely monitor market reactions to this high-impact economic data.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations