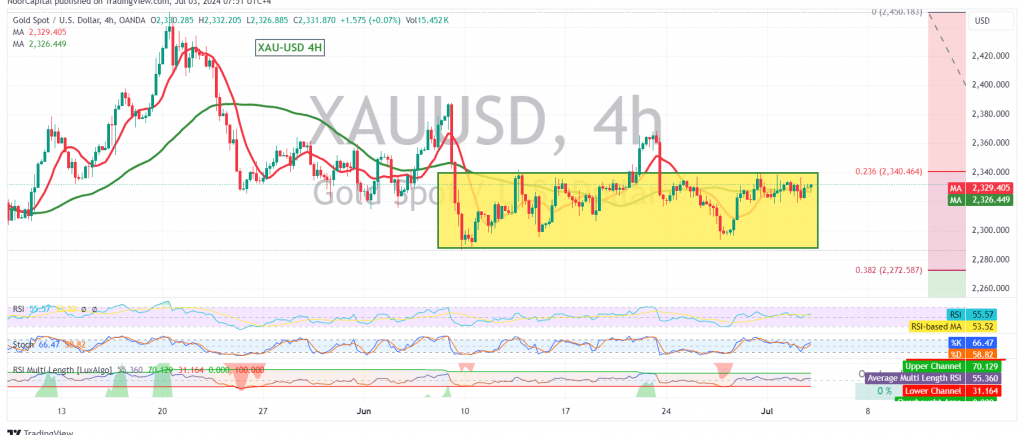

Gold prices continue to trade within a tight range, bounded by the 2317 support level and the 2340 resistance level.

Technical Outlook:

The technical outlook remains unchanged, with a bearish bias prevailing. The price continues to trade below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart, and the 50-day simple moving average (SMA) continues to act as a dynamic resistance, reinforcing the downward pressure.

Downside Targets:

A break below the 2317 support level would likely accelerate the downward correction, with potential targets at 2300 and 2297. The primary target for this bearish wave remains at 2272.

Potential Reversal:

Traders should be aware that a sustained break and consolidation above the 2340 resistance level could invalidate the bearish scenario. In this case, a potential recovery towards 2348 and even 2357 could be expected.

Key Levels:

- Resistance: 2340 (23.60% Fibonacci retracement), 2348, 2357

- Support: 2317, 2300, 2297, 2272

Important Note:

The release of high-impact U.S. economic data today, specifically the ADP Non-Farm Employment Change report, could significantly impact gold prices. Traders should exercise caution and closely monitor the market’s reaction to this announcement.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations