The precious metal witnessed negative trading in the previous trading session, after two consecutive sessions of rising to retest 1807.

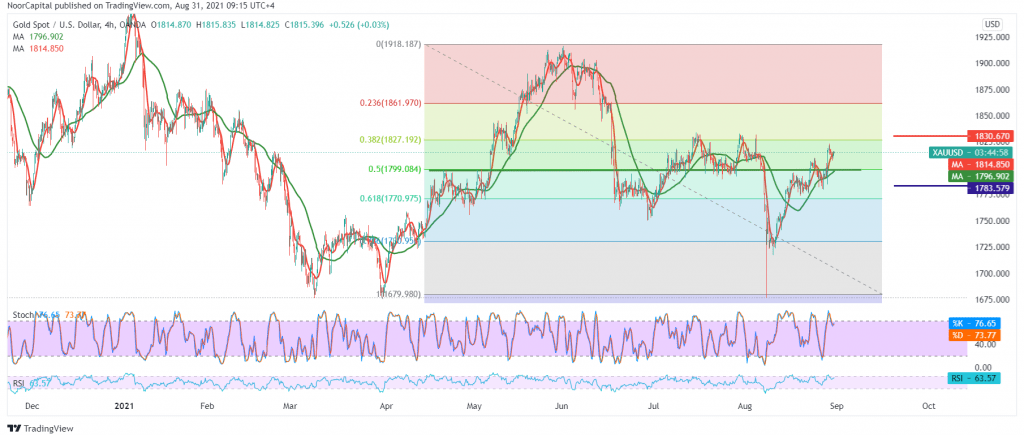

Technically, and by looking at the 240-minute chart, we find the stochastic is trying to provide positive signals and is supported by the positive motive coming from the 50-day moving average.

On the other hand, we find that the Relative Strength Index started to send warning signs that tend to be negative. With the technical signals conflicting, we will stand aside for the moment until the direction becomes clearer more accurately, waiting for one of the following scenarios:

To resume the bullish path, we need to witness a clear and strong breach of the resistance level of 1823, which increases the strength of the bullish trend, opening the way directly towards 1830/1831, and the gains may extend later towards 1840.

Reactivating the short positions requires confirming the breach of the pivotal support level 1799 represented by the 50.0% Fibonacci correction, which puts the price under strong negative pressure; its initial targets are located around 1791 and extend towards 1785.

| S1: 1807.00 | R1: 1823.00 |

| S2: 1799.00 | R2: 1831.00 |

| S3: 1791.00 | R3: 1839.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations