Mixed trades dominated the yellow metal prices yesterday within random movements that tended to be negative, recording its lowest level at 1855.

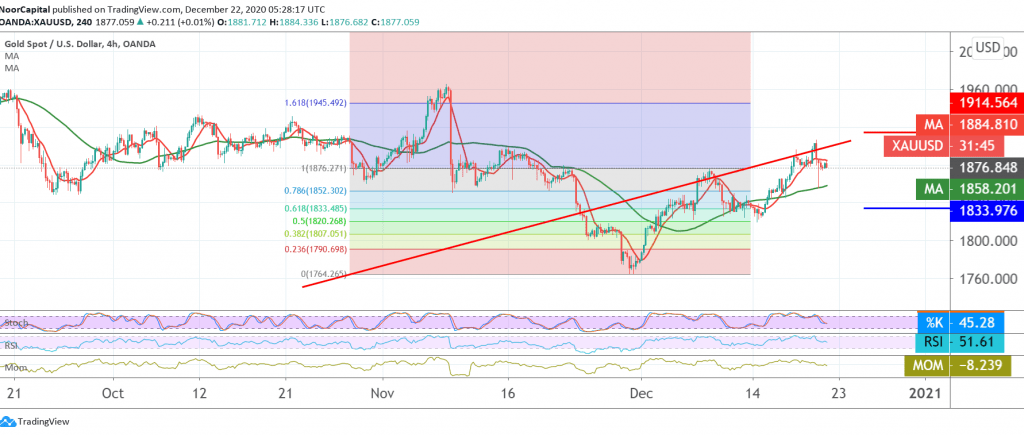

Technically, and by looking at the 240-minute chart, we found a conflict between the clear negativity on the stochastic indicator, which supports the continuation of the decline, and the continuation of gold getting a positive stimulus from the 50-day moving average, which still holding the price from below and is accompanied by the stability of the strength indicator Relativity above the middle cheek advancing positive signals.

From here, and with the conflict of technical signals, we will stand on the fence and waiting for the one of the following scenarios:

Resuming the rise requires an intraday stability above 1866. We also need to witness a clear and strong breach of the resistance level of 1890 in order to enhance the chances of the upside with the first target of 1907 and 1915, respectively.

Activating short positions depends on confirming the break of 1866, which puts the price under negative pressure. Its initial target is 1853, while its second target is around 1833, a correction of 61.80%.

Note: The level of risk is high and careful consideration is required.

| S1: 1853.00 | R1: 1907.00 |

| S2: 1828.00 | R2: 1930.00 |

| S3: 1800.00 | R3: 1955.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations