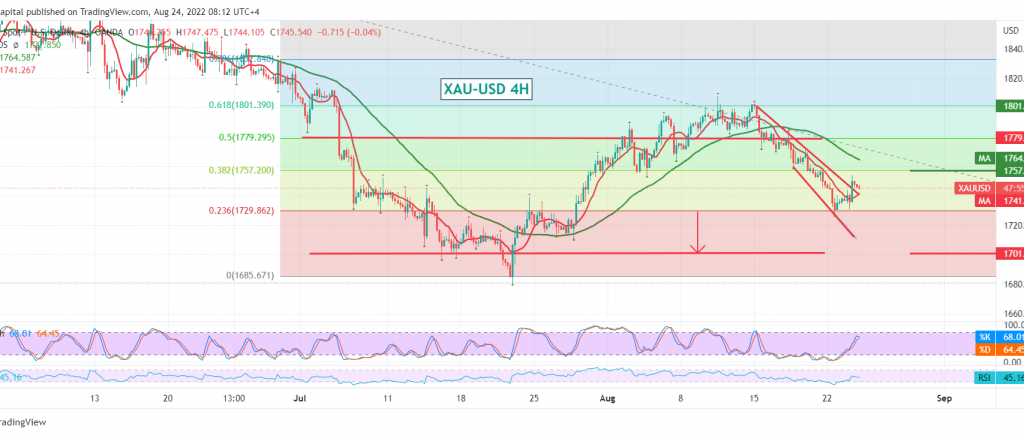

We adhered to intraday neutrality during the previous session, explaining the importance of the current trading levels, in addition to the conflict in the, explaining that the continuation of gold prices above the recorded bottom $1727 increases the probability of touching $1472 and $1755 respectively, to touch the required target, recording the highest level at $1755.

On the technical side today, and by looking at the 4-hour chart, we notice the continuation of the movement below the 50-day simple moving average, accompanied by the loss of the bullish momentum stochastic, and that is the technical factors that support the decline, in addition to the stability of daily trading below 1755, on the other hand, we find the 14-day momentum indicator that started in providing positive signals.

Therefore, with technical signals conflicting, we prefer to monitor the price behaviour to be in front of one of the following scenarios:

To resume the current downside wave, we need to witness confirmation of breaking 1729, 23.60% correction, targeting 1719 and 1708, respectively, while consolidation above 1757, 38.20% correction, is a catalyst that may enhance the possibility of retesting 1767.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations