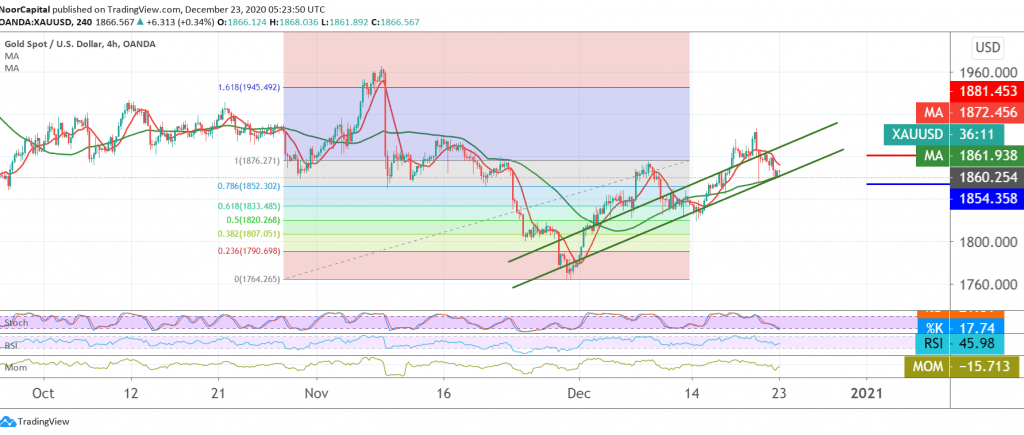

Negative trading dominated the price of the yellow metal during the previous trading session after it found a resistance level near 1885, which forced it to re-test the support level published during the previous analysis located at 1866, which we made clear that breaking this level is a condition of activating short positions.

On the Technical side, with a closer look at the 240-minute chart, we find the 50-day moving average is trying to push the price to the upside. This comes in conjunction with the emergence of positive crossover signals on the stochastic, and this contradicts the stability of trading below 1880 accompanied by the continuous RSI providing negative signals.

Therefore, we prefer to remain neutral for the moment until the picture becomes clearer, to be in front of one of the following scenarios: To get a bearish trend, we need to witness a break of 1858 and most importantly support for the ascending channel 1855, which puts the price under strong negative pressure targeting 1833 a correction of 61.80%, and then 1820 a correction of 50.0% As initial targets, which may extend later to 1807.

Reactivating long positions requires that we witness the breach of 1881, which is able to enhance the chances of a rally towards 1895 and extend the gains later towards 1907. Note: The risk level may be high today.

| S1: 1855.00 | R1: 1880.00 |

| S2: 1845.00 | R2: 1895.00 |

| S3: 1833.00 | R3: 1906.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations