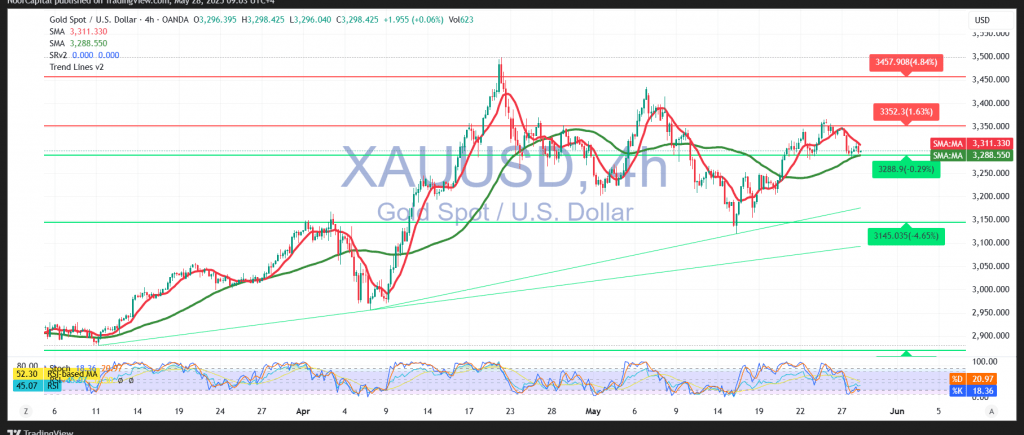

Gold prices are currently trading within a narrow range, consolidating between $3,300 support and $3,350 resistance. This consolidation reflects a pause in momentum following recent gains, as the market awaits key catalysts.

From a technical perspective, the underlying bullish trend remains intact. The Relative Strength Index (RSI) is showing signs of renewed upward momentum, having rebounded from oversold territory and holding above the 50-midline. This is further supported by simple moving averages, which continue to provide dynamic support and limit downside risks.

As long as price action remains steady above $3,270, the bias favors the bulls. The next upside target is $3,311, with a break above this level potentially accelerating gains toward $3,336.

However, if the price fails to hold above $3,270, the bullish scenario could be invalidated, opening the door for a downward corrective phase. In this case, initial support levels to watch are $3,245 and $3,212.

Key Event Risk Today:

Traders should exercise caution ahead of the release of the Federal Reserve meeting minutes, a high-impact event that could introduce significant volatility into the market.

Risk Disclaimer:

Amid ongoing global trade tensions and macroeconomic uncertainty, risk levels remain high. Traders should remain vigilant and prepared for sudden shifts in market sentiment.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations