Gold prices concluded last week’s trading sessions on a notably positive note, surpassing the psychological barrier resistance level of $2,000, consistent with the anticipated positive outlook. The prices approached the official target of 2007, reaching a peak of $2,003 per ounce.

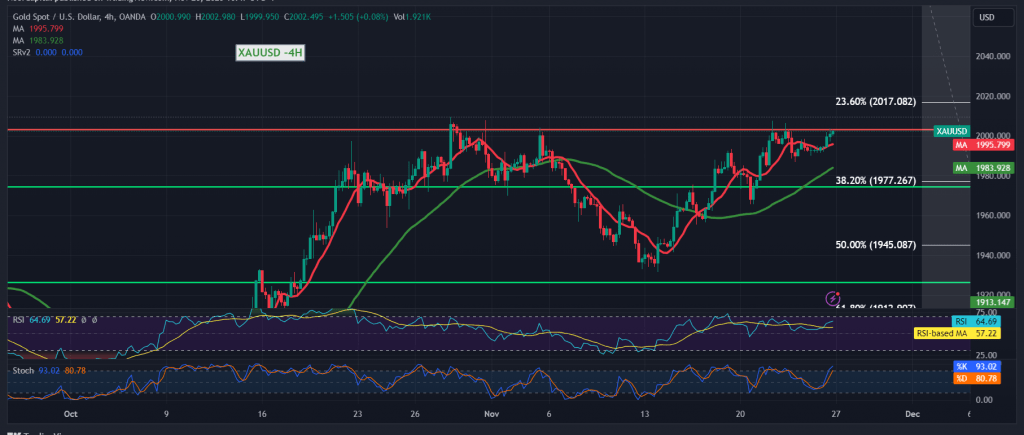

From a technical standpoint, examining the 4-hour time frame chart reveals that the simple moving averages persist in lifting the price from below, supporting the upward daily trend. Moreover, intraday trading remains above 1993.

In the broader context, as long as there is stability in trading above the crucial support floor of 1977, representing the 38.20% Fibonacci retracement, this reinforces positive expectations. This is a fundamental condition for breaking through 2007, paving the way for substantial gains, initially in 2012 and 2017 and extending towards 2021.

However, the failure of gold prices to consolidate above the main support at 1977 introduces significant negative pressure. In such a scenario, a trading session in negative areas ensues, with targets initiating at 1963.

The associated risks may be elevated, and it’s imperative to monitor directional cues—below in 1977 and above in 2007.

Warning: The level of risk is high amid ongoing geopolitical tensions, potentially leading to heightened price volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations