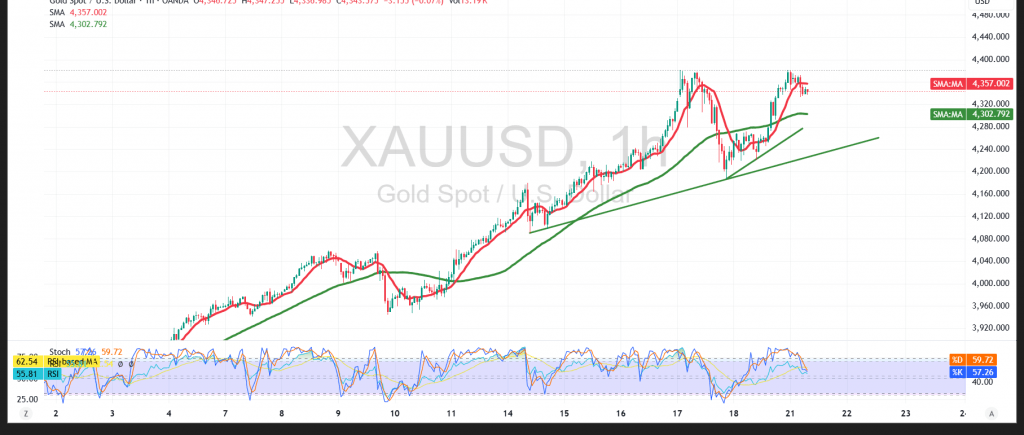

In the prior note we flagged indecision and said an hourly close above 4,280 would confirm bullish continuation toward 4,350. Since then, gold has held above 4,245, turning that area into a key support while price compresses beneath nearby resistance.

Technical (4H):

Price action is clearly above 4,245, reinforcing role-reversal support and providing a firm floor against deeper pullbacks. Up-sloping SMAs confirm intact bullish momentum. RSI is rotating out of overbought, which can allow a shallow, tactical dip before trend resumption, but the broader structure remains constructive.

Base case:

If trading stays capped below 4,380, a fade toward 4,245 is plausible to refresh momentum before buyers attempt another push higher.

Alternative (breakout):

A clean break and hourly close above the 4,381 record high would likely extend the up-leg toward 4,407 and then 4,425.

Risk:

Gold’s risk profile is elevated and may not suit all investors. Trade/geopolitical headlines can drive abrupt, two-way moves—use disciplined sizing, clear invalidation levels, and avoid overexposure around events.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 4245.00 | R1: 4407.00 |

| S2: 4151.00 | R2: 4475.00 |

| S3: 4083.00 | R3: 4569.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations