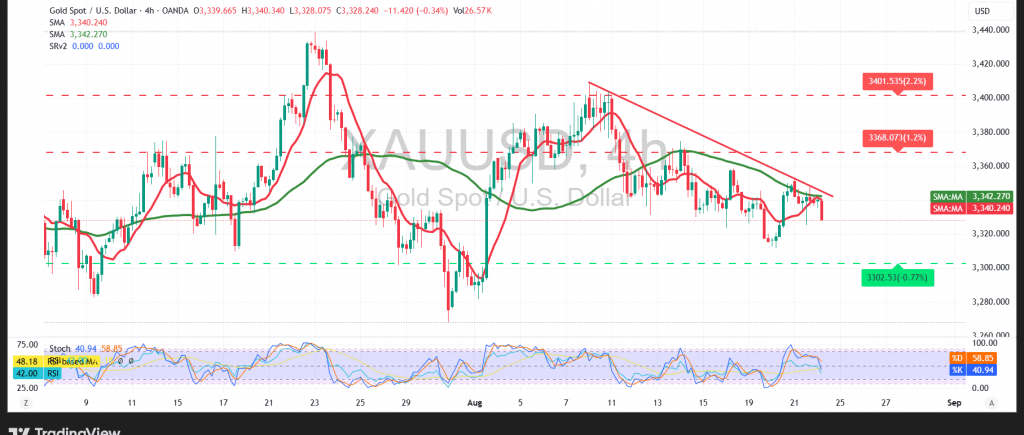

Gold prices attempted a bullish rebound during the previous trading session, but gains remained limited after they hit the pivotal resistance level of 3355, which successfully curbed the upward momentum and stopped the positive thrust.

Technical Outlook – 4-Hour Timeframe

Intraday movements are trending downward, retesting the support level of 3328, as the price remains below the 50-day Simple Moving Average, which acts as dynamic resistance. Conversely, the Relative Strength Index (RSI) is near oversold regions, which may reflect attempts by buyers to capture short-term bullish trades.

Probable Scenario:

Given the conflicting technical signals, we prefer to monitor the price action to be ready for one of the following scenarios:

Continued selling pressure will be confirmed by a break below and consolidation below 3320, which would pave the way for a deeper decline towards 3310 and then 3290.

Fundamental Note:

We are awaiting high-impact economic data today, namely “Jerome Powell’s speech at the Jackson Hole Economic Symposium throughout the day.” This event could cause strong volatility in price movements.

Warning: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios may be plausible.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3320.00 | R1: 3310.00 |

| S2: 3290.00 | R2: 3345.00 |

| S3: 3360.00 | R3: 3368.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations