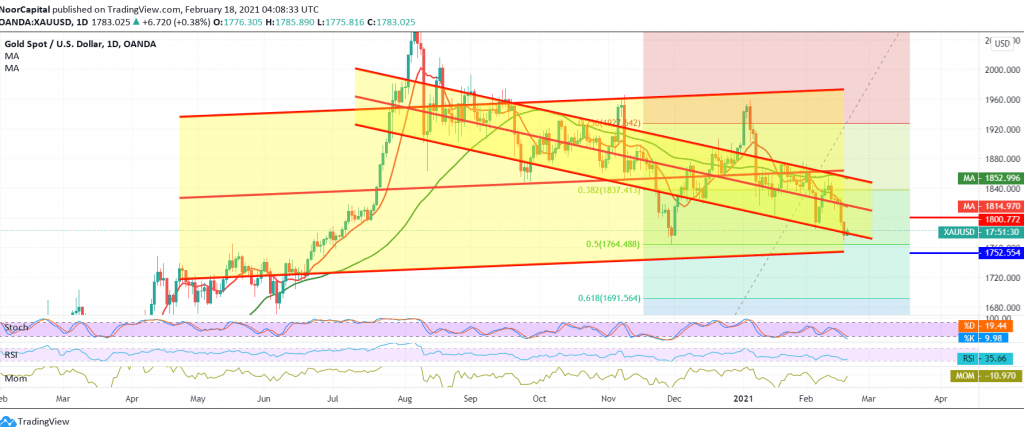

Gold prices were exposed to a strong downward wave, as we expected in the previous analysis, touching the first target to be achieved at 1777, approaching a few points from the official target of 1765, to record the lowest price of 1769.

Technically, the intraday trading remains below the resistance level 1788 that supports the continuation of the decline, and we find that the RSI indicator continues to provide negative signals on short intervals. Consequently, the bearish scenario will remain valid and effective targeting 1770 and 1765 50.0% retracement, respectively.

It should be carefully noted that breaking 1765 and stabilizing below it forces gold to resume the current downside wave, so the way is open directly towards 1755 initially. In general, we continue to suggest the daily bearish trend as long as trading is stable below 1795.

| S1: 1770.00 | R1: 1795.00 |

| S2: 1755.00 | R2: 1808.00 |

| S3: 1743.00 | R3: 1821.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations