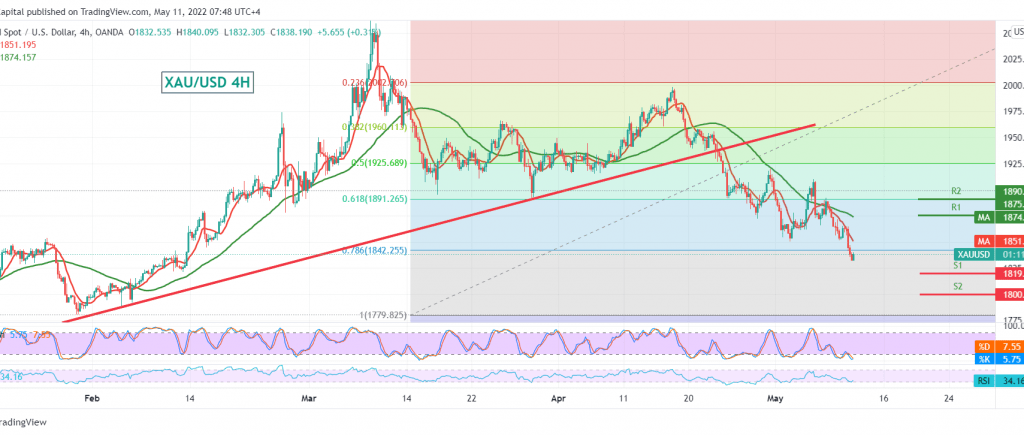

The minor bearish trend continues to dominate the movements of the yellow metal, as we expected, touching the official target station during the previous analysis at 1831, recording its lowest level at 1831.

On the technical side, today, gold prices found a strong resistance level around 1866, which forced the price to settle negatively. With careful consideration of the 240-minute chart, we find that the RSI continues to provide negative signals accompanied by the continuation of the negative pressure coming from the simple moving averages.

From here and steadily intraday trading below 1857 and most importantly below the previously broken support and turned into the 1866 resistance level, the bearish scenario remains the most preferred, knowing that the decline below 1831 extends the losses of gold so that we are waiting for 1823 first target and then 1810 next waiting station that may extend later towards 1800 As long as the price is stable below 1866, and in general, the minor bearish trend is not likely unless we witness a trading exponent above 1890 represented by the 61.80% Fibonacci correction.

Note: the risk level may be high today.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations