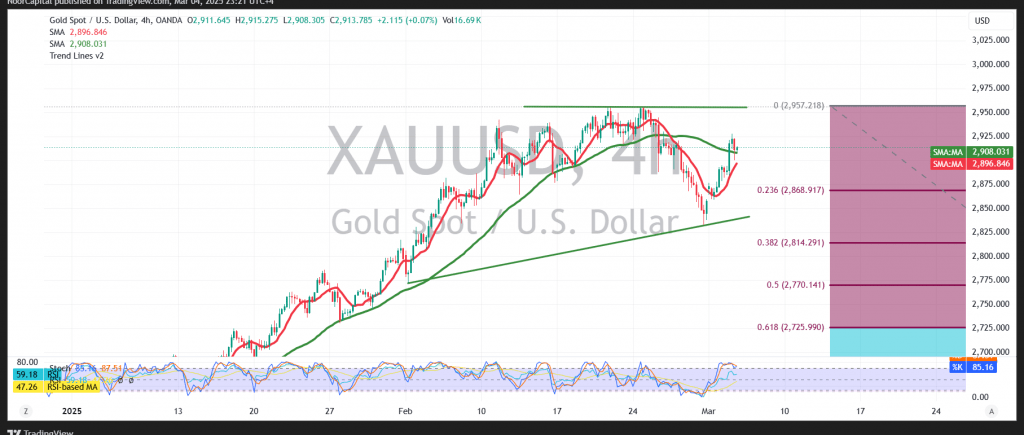

Gold continued its upward trend, in line with our previous outlook. The breach of 2893 acted as a catalyst, pushing prices toward the first target of 2910 and the second target of 2920, with the recent high reaching $2927 per ounce.

Technical Outlook

- Bullish Signals:

- The Relative Strength Index (RSI) remains supportive of the upward trend.

- Gold prices are holding above the 50-day simple moving average, which continues to provide support from below.

- Key Levels:

- With daily trading stable above the previously breached resistance—now acting as support at 2886 (per the role exchange concept)—the bullish momentum is likely to continue.

- A break above 2932 could facilitate a move toward an initial target of 2952.

- Bearish Scenario:

- A return to stability below 2886 may trigger temporary negative pressure, potentially driving prices to retest 2865 and 2860 before any recovery.

Risk Warning

- Economic Data: High-impact US economic data, particularly the “non-farm private sector employment data,” is expected today, which could lead to heightened volatility.

- Market Conditions: Ongoing trade tensions and other risks continue to pose challenges, and all scenarios remain possible.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations