In the recent trading session, gold prices experienced significant losses in line with the negative technical forecast, meeting our earlier expectations. The precious metal touched the second official target at $1958, reaching its lowest point at $1956 per ounce.

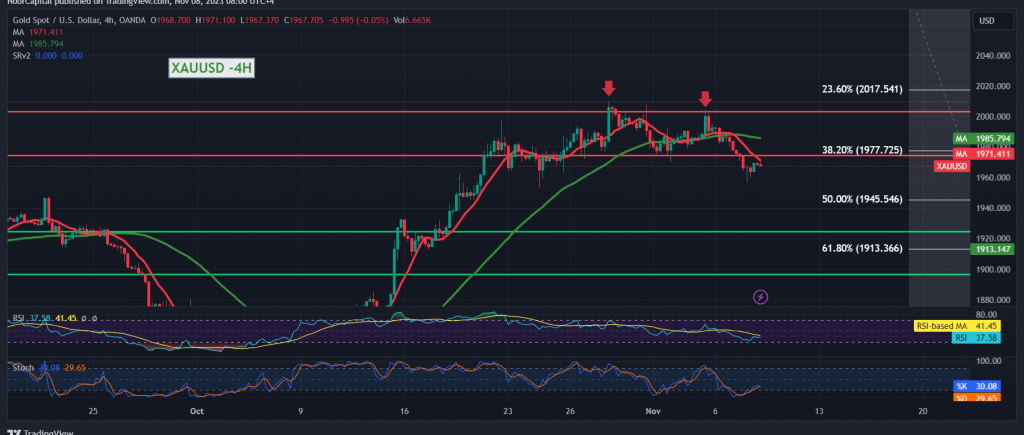

Today’s technical analysis continues to point towards a potential downtrend. Examining the 4-hour interval chart, we observe that the simple moving averages are exerting downward pressure on the price from above. This bearish influence aligns with the formation of a negative technical pattern on the same chart, indicating further downside potential.

With this scenario in mind, our bearish outlook persists. A breach below the $1956 level could extend the losses, targeting 1945, a key level represented by the 50.0% Fibonacci retracement. This level holds significant importance in determining the short-term trend. A break below 1945 would pave the way towards 1934.

It is crucial to note that the implementation of this bearish scenario hinges on the price maintaining stability below the previously breached support, now acting as resistance at $1977 (Fibonacci retracement 38.20%). If this level is breached, it may delay the potential decline, leading to a retest of 1990 and 1993 before further downward attempts.

Investors should exercise caution as we anticipate high-impact events, including speeches from Federal Reserve Governor Jerome Powell and Bank of England Governor, which might result in increased price volatility.

Warning: The market remains highly volatile due to ongoing geopolitical tensions. Traders are advised to approach trading with heightened awareness and prudent risk management strategies.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations