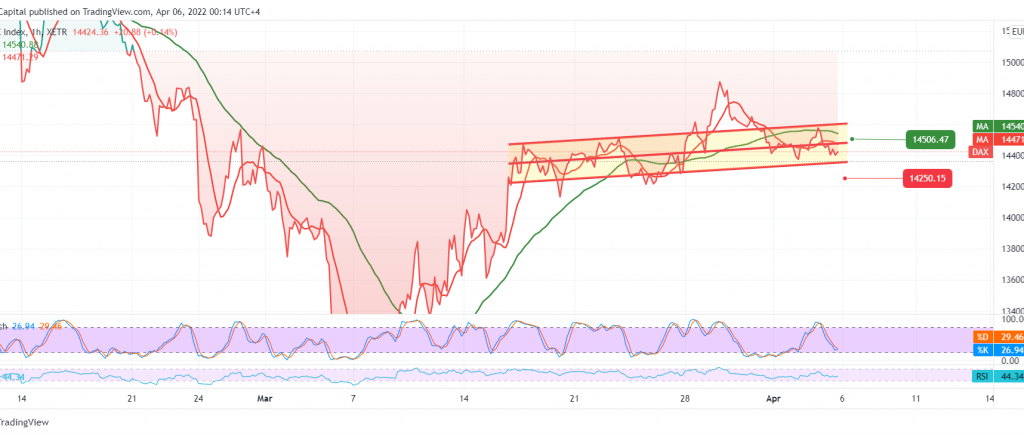

During the previous analysis, the German DAX index declined to reflect the expected bullish trend, only to record its highest level during the last session’s trading at 14,620.

Technically, today, the current movements of the index are witnessing the price’s pivot below the 14,500 area, most importantly below 14,550, and we notice that the stochastic indicator has lost the bullish momentum on the short time frames.

There may be a possibility to witness more declines during today’s session. The decline below 14,350 extends the index’s losses to open the door toward 14,285 first target, and then 14,185 as long as the price is stable below 14,550.

Note: Fed’s statement is due today and may cause high volatility.

Note: The risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 14285 | R1: 14550 |

| S2: 14185 | R2: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations