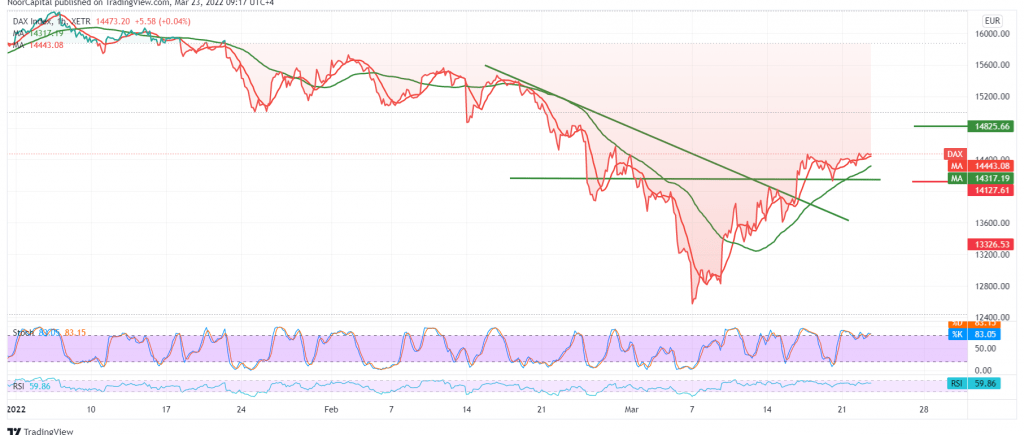

Positive trading dominates the movements of the German DAX index, recording its highest level during the early trading of the current session, around 14,540.

On the technical side today, the index was able to build for the moment on the support floor of 34,370, as we find the 50-day moving average that provides a positive stimulus, accompanied by the stability of the momentum indicator above the mid-line 50.

There may be a possibility of an upward bias during the day, provided that we witness a clear and strong breach of the resistance level 14,540, which may facilitate the task required to visit 14,590 first targets, Then 14,680, targets may extend later to visit 14,820.

The activation of the proposed scenario depends on the stability of the index price above 14,370 and generally above 14,230. Breaking the latter may stop the proposed scenario, and we witness bearish movements with a target of 14,140.

Note: The risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 14370 | R1: 14590 |

| S2: 14230 | R2: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations