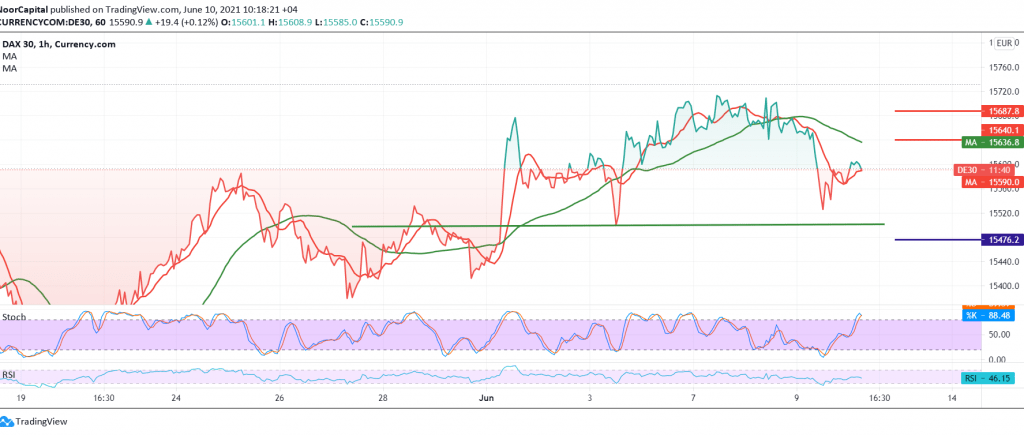

Mixed trading dominated the movements of the German DAX index to retest the strong support level of 15,500.

On the technical side, we tend in our intraday trading to be positive, but with caution, relying on the continued attempts of the RSI to obtain bullish momentum, in addition to stabilizing trading above 15,530 and most importantly 15,500.

Therefore, the bullish scenario is the most preferred, but with caution, provided that the breach of 15,610 is confirmed to target 15,640 and 15,685, respectively.

Confirmation of breaking the pivotal support 15,500 will immediately stop any bullish movements for the index, and we will witness a descending wave whose initial target is 15,475 and extending towards 15,440. Note: The risk level is high.

| S1: 15530 | R1: 15610 |

| S2: 15475 | R2: 15640 |

| S3: 15445 | R3: 15685 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations