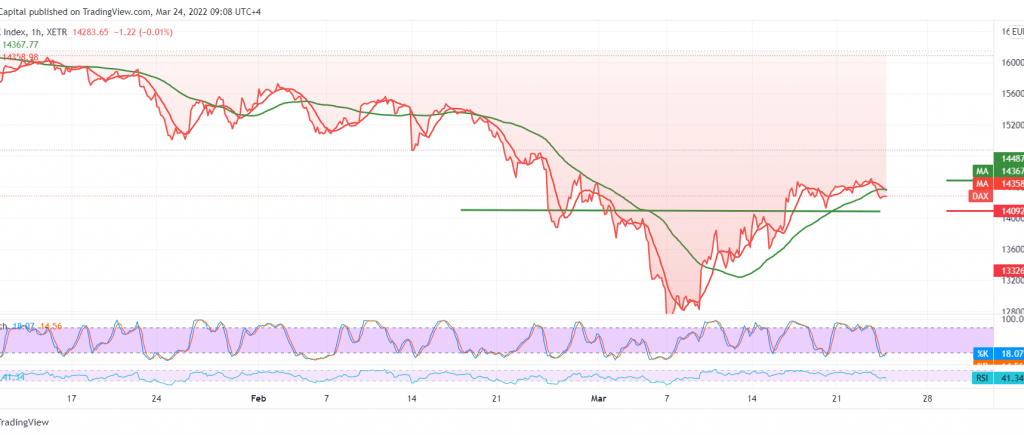

In the previous session, the German DAX index experienced strong selling after it failed to maintain trading above 14,400 levels to record the lowest at 14,212.

Technically, by looking at the 4-hour chart, we notice the negative pressure leading from the 50-day moving average, accompanied by the clear negative signs on the stochastic indicator.

Therefore, there may be a possibility to resume the decline that started yesterday, provided that we witness a clear and strong break of the 14,200 support level to open the door towards 14,090 first target, and breaking it forces the index to witness more negative moves towards 13,960 and 13,710 as long as the index is stable below 14,470.

Note: The risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 14090 | R1: 14470 |

| S2: 13960 | R2: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations