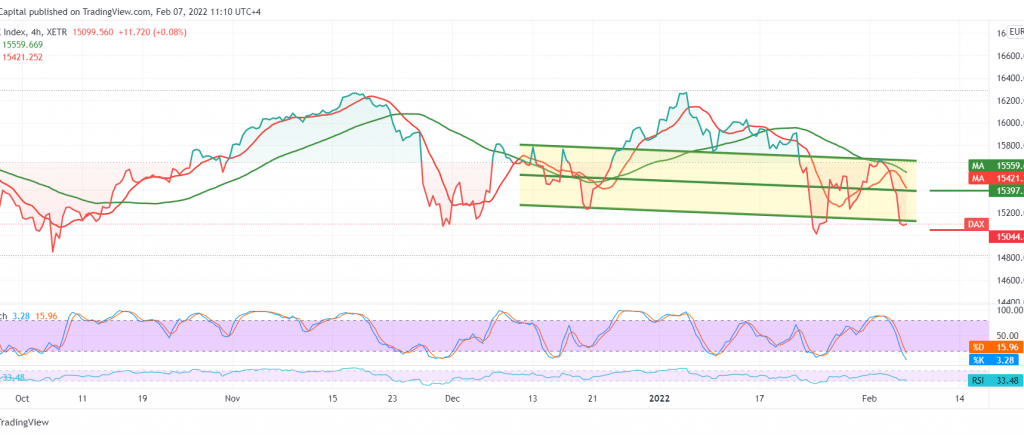

The German DAX index started its first weekly move on a slight bullish slope, benefiting from the pivotal support level of 15,100. It is now hovering around its highest level during the early trading of the current session 15,19.

Technically, the 60-minute chart indicates the possibility of continuing the rise as the index is settled above the 50-day moving average, in addition to the positive signs of the 14-day momentum indicator.

Consolidation above 15,200 may contribute to consolidating the index’s gains to visit 15,240 and 15,280 areas, respectively, in the condition of intraday stability above 15,100 and in general above 15,065.

Trading below 15,065 postpones the idea of the rise, and we may witness a bearish slope that aims to retest 15,000.

Note: the level of risk is high.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 15170 | R1: 15205 |

| S2: 15130 | R2: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations