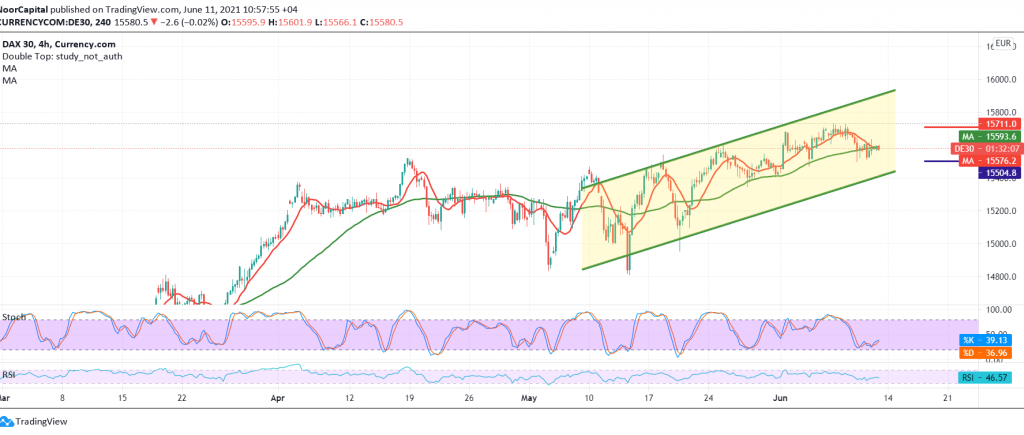

The German DAX index managed to touch the first awaited target mentioned in the previous analysis, which is located at 15,640, to record its highest level during the previous trading session, 15,637.

On the technical side today, and with a closer look at the hourly chart, the simple moving averages are still bullish, and this comes in conjunction with the positive signals on the RSI.

Therefore, with the stability of trading above the pivotal support line 15,500, the bullish bias will remain valid and effective, targeting 15,640, and its breach will increase and accelerate the strength of the bullish trend, so that the path is directly open towards 15,700, and gains may extend later towards 15,760.

Trading below 15,500 and stabilizing the price below it is considered a sign of a negative trend with a target of 15,450 and 15,390, respectively. Note: the level of risk may be high.

| S1: 15500 | R1: 15640 |

| S2: 15450 | R2: 15700 |

| S3: 15385 | R3: 15765 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations