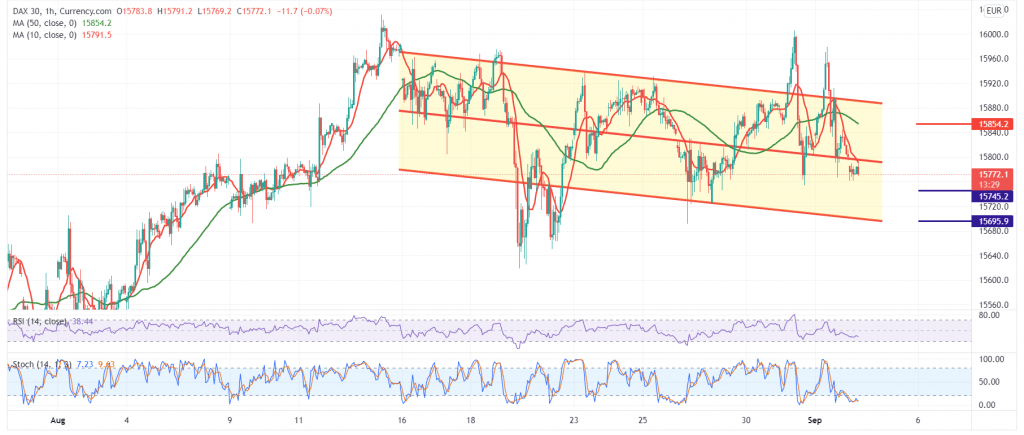

The current moves of the German DAX index are witnessing a bearish tendency after it hit the resistance level of 15,980 within a bearish slope that is close to retesting the support level of 15,750.

On the technical side, there is a conflict between the technical signals, the stability of the index price above the support level of 15,750 increases the possibility of rising accompanied by attempts to obtain the RSI to gain bullish momentum, on the other hand, we find the 50-day moving average pressing on the price from above.

Therefore, the market will stand on the sidelines until the daily trend becomes clearer more accurately, waiting for one of the following scenarios: Short positions requires breaking 15,750 to target 15,700, and losses may extend later towards 15,640.

Long positions depend on confirming the breach of 15,860, which allows the index to touch 15,910 and 15,980. Note: the level of risk is high.

| S1: 15700 | R1: 15910 |

| S2: 15635 | R2: 16045 |

| S3: 15495 | R3: 16120 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations