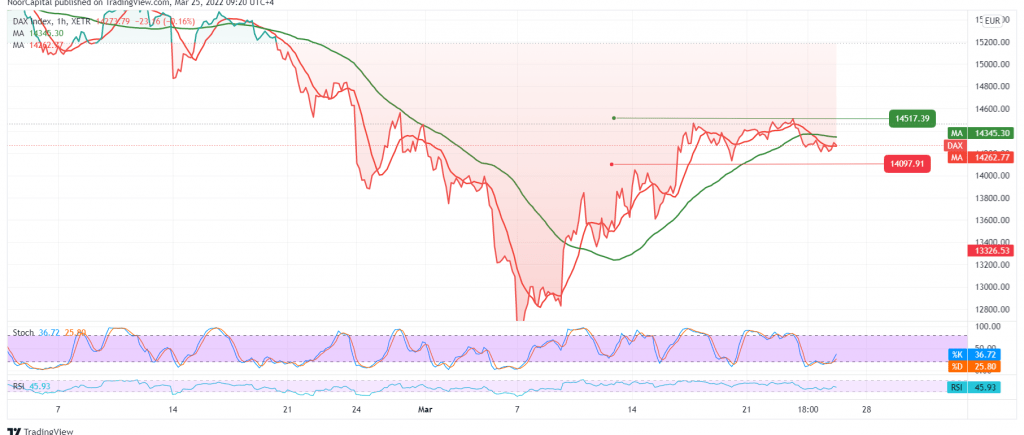

Positive moves dominated the German DAX index’s movements yesterday, building on solid support floor 14200, which we previously mentioned as one of the most important directional keys.

On the technical side, the 50-day simple moving average has returned to hold the price from below, as we find the 14-day momentum indicator that provides positive signals that increase the possibility of positive movements in the coming hours.

Therefore, consolidation above 14,390 may enhance the index’s gains in the short term, to visit 14,430, a first target, and gains may extend later to visit 14,510, and gains may extend towards 14,610 as long as the price is stable above 14,100.

Note: The risk level is high

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: 14240 | R1: 14430 |

| S2: 14120 | R2: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations