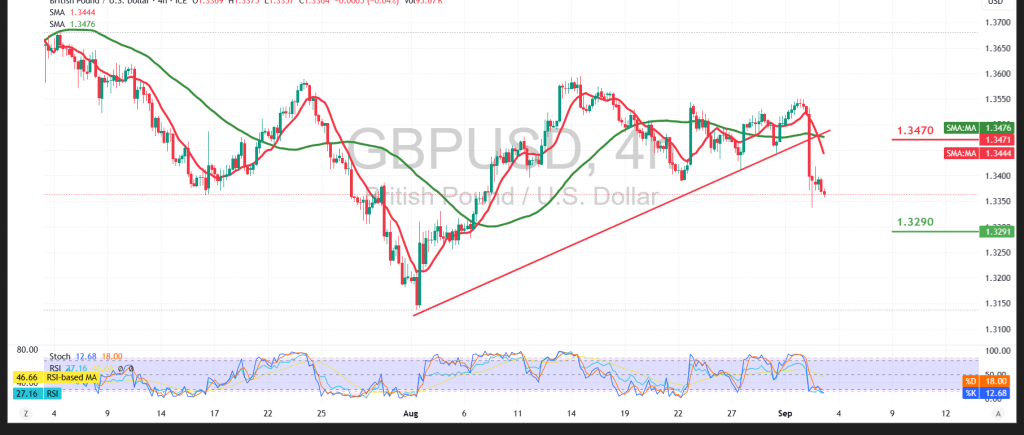

The GBP/USD pair posted sharp losses in the previous trading session after encountering strong resistance at 1.3550, the prior target level.

Technical Outlook – 4-hour timeframe:

Current price action reflects a clear bearish bias following a break of the short-term ascending trend line. In addition, the pair continues to trade below the simple moving averages, which have now turned into dynamic resistance, reinforcing the downside outlook.

Likely Scenario:

The 1.3460 level now acts as resistance under the role-reversal principle. A confirmed break below 1.3350 would accelerate bearish momentum, paving the way for a broader decline toward the next support levels highlighted on the chart. Conversely, a move back above 1.3470 could trigger a short-term reversal, allowing for a retest of higher resistance areas.

Fundamental Note:

Today’s session includes high-impact US economic data, namely the Job Openings and Labor Turnover Survey (JOLTS), which may spark significant volatility in the market.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3290 | R1: 1.3500 |

| S2: 1.3210 | R2: 1.3630 |

| S3: 1.3080 | R3: 1.3710 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations