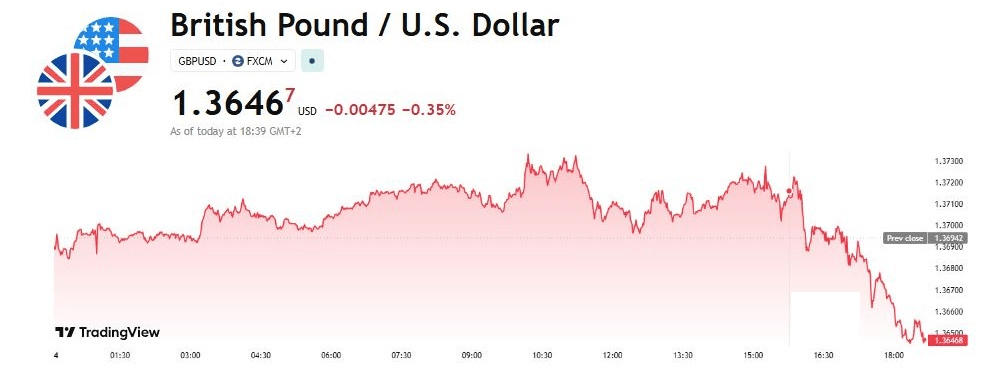

Sterling Consolidates Below 1.3700 Ahead of BoE Decision

The British pound slipped against the US dollar on Wednesday, trading below the 1.3700 mark with losses of around 0.23%, as markets braced for the Bank of England’s monetary policy announcement. The dip comes amid mixed investor sentiment, with a modestly supported dollar after robust US services data and lingering concerns about UK inflation and unemployment shaping expectations for future rate moves.

Source: TRADINGVIEW

US Services Show Steady Growth Despite Slower Hiring

US economic data for January highlighted continued expansion in the services sector. The ISM Services PMI came in at 53.8, above market forecasts of 53.5 and matching December’s reading. However, the employment sub-index fell to 50.3 from 51.7, signaling slower job growth in the sector. Meanwhile, the Prices Paid index—a key gauge of inflation—rose from 65.1 in December to 66.6, its highest level in two months, pointing to persistent price pressures.

Private payrolls also disappointed: the ADP Employment Change report showed that US companies added just 22,000 jobs in January, falling short of the 48,000 estimate. These figures nudged the dollar slightly higher, with the US Dollar Index (DXY) rising 0.13% to 97.51, as investors awaited the broader employment data that had been temporarily delayed by a brief US government shutdown.

UK Services Continue Expanding, Prices Remain Elevated

Across the UK, preliminary January data showed strong growth in the services sector, highlighting resilient business activity. Yet inflationary pressures, particularly from rising food and wage costs, suggest the Bank of England will remain cautious in easing monetary policy. Headline inflation reached 3.4% in December—still the highest among G7 economies—but is expected to gradually approach the central bank’s 2% target over the next two years.

Bank of England Poised To Hold Rates at 3.75%

Markets widely expect the BoE to maintain its Bank Rate at 3.75% in Thursday’s meeting, signaling a “gradual and cautious” approach. Investors anticipate the first 25-basis-point cut may come in April, coinciding with regulatory adjustments to energy pricing that are expected to ease inflation. The BoE is also set to release its first monetary policy report of 2026, offering updated economic forecasts, the expected impact of budget measures on price growth, and analysis of global trade pressures, including US tariffs.

Monetary Policy Committee Dynamics

The Bank’s decision reflects a delicate balance between slowing growth, rising unemployment, and easing—but still persistent—inflation. The narrow December vote to cut rates from 4% to 3.75% highlighted the committee’s cautious stance. Some members remain concerned that wage growth could outpace productivity gains, while others emphasize the need to let inflation trends stabilize before signaling aggressive cuts. Despite these internal differences, the BoE’s guidance suggests a measured pace of easing over 2026, with potential cuts later in March and June.

Global Factors Keep Sterling Under Pressure

The pound remains vulnerable to external volatility. January’s geopolitical shocks—including US actions in Venezuela and threats from the Trump administration regarding NATO allies—illustrate the uncertainty influencing currency markets. However, the BoE appears focused on domestic factors, prioritizing inflation control and stable growth over reacting to short-term global shocks.

Outlook and Market Implications

Sterling faces a critical period as markets digest the BoE’s policy stance, alongside mixed US economic signals. The central bank is expected to hold rates steady at 3.75%, signaling a gradual approach while inflation moderates. Investors will be closely watching any commentary for clues on future rate cuts, while broader market sentiment remains sensitive to both UK domestic trends and US economic developments.

GBP/USD remains below 1.3700 as the Bank of England prepares to hold interest rates steady amid persistent inflation. US services data showed solid growth but slower job creation, supporting the dollar. The BoE’s cautious stance—emphasizing gradual policy easing—reflects ongoing challenges in balancing inflation, wage pressures, and economic growth, while global uncertainties continue to influence sterling volatility.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations