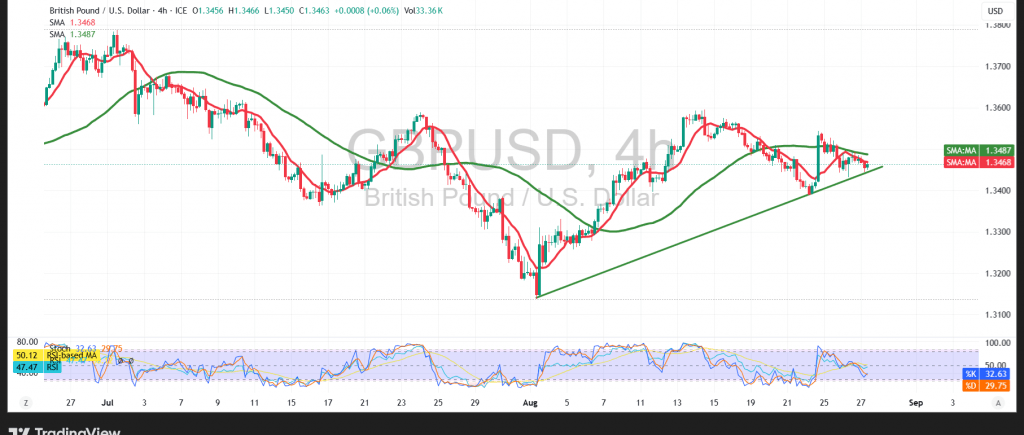

The GBP/USD pair is under negative pressure in the morning session as it approaches the psychological resistance level of 1.3500.

Technical Outlook – 4-hour timeframe:

The pair’s stability below the simple moving average continues to reinforce the possibility of extended downside pressure. However, the Relative Strength Index (RSI) has started to show early positive signals, which could support renewed bullish attempts.

Probable Scenario:

As long as the price remains above the 1.3435 support, the bullish scenario remains favored, with upside targets beginning at 1.3500 as initial resistance, followed by 1.3530. Conversely, a confirmed break below 1.3435 would reintroduce selling pressure, exposing the pair to further downside toward 1.3400.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3435 | R1: 1.3500 |

| S2: 1.3400 | R2: 1.3560 |

| S3: 1.3365 | R3: 1.3590 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations