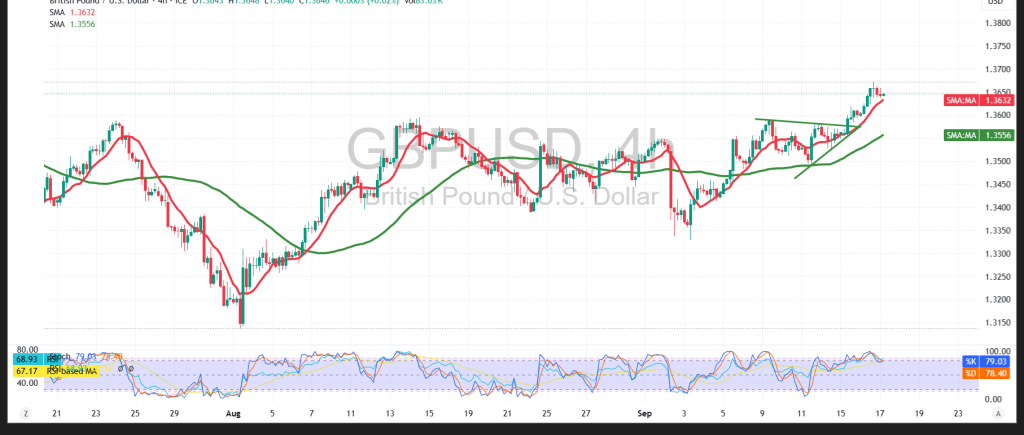

The pair extended its advance in line with previous expectations, reaching the projected target at 1.3675, which also marked the session high.

Technical Outlook:

- RSI: The Relative Strength Index is starting to issue negative signals, hinting at a potential short-term slowdown in bullish momentum.

- 50-SMA: The 50-period Simple Moving Average continues to provide dynamic support, reinforcing the short-term uptrend bias.

Likely Scenario:

- Key Support: 1.3600 – and more importantly 1.3590 – are critical to maintaining the bullish setup.

- Upside Potential: A break above 1.3680 could trigger intraday gains towards 1.3715, with further extension possible to 1.3760.

- Downside Risk: A confirmed break below 1.3590 would shift the bias back to bearish, exposing the pair to support levels near 1.3530.

Risk Note: Markets are bracing for a package of high-impact U.S. releases today: the FOMC statement, Fed economic outlook, Chair Powell’s press conference, and the Federal Funds Rate decision. High volatility is likely.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3605 | R1: 1.3680 |

| S2: 1.3565 | R2: 1.3715 |

| S3: 1.3530 | R3: 1.3760 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations