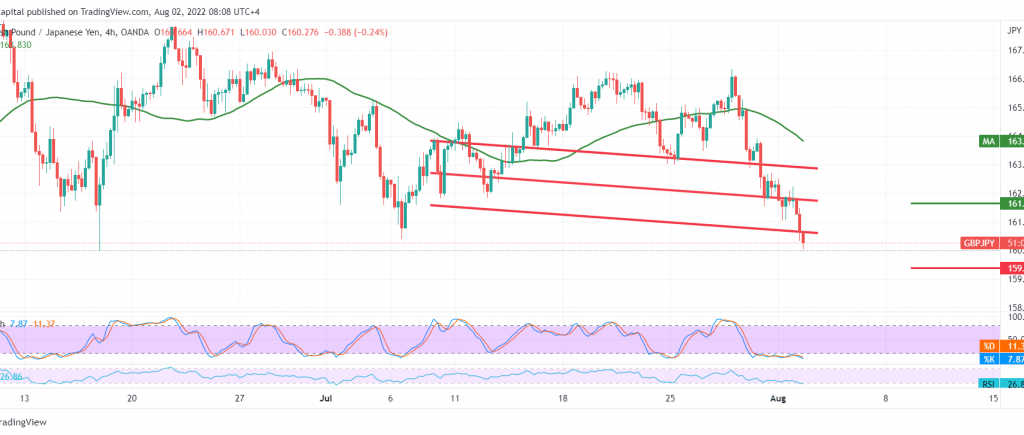

The British pound fell against its Japanese rival significantly, at the beginning of this week’s trading, within the expected negative outlook during the previous analysis, touching the first awaited target at the price of 160.40, recording its lowest level at 160.03.

Technically, the bearish trend is still dominating the pair’s movements, with the continuation of the negative pressure coming from the simple moving averages that reinforce the bearish path, in addition to the clear negative signs on the stochastic indicator.

Therefore, the bearish scenario will remain valid, knowing that the decline below 160.00 increases and confirms the strength of the bearish daily trend so that we will be waiting for 159.50 first target, and losses may extend later to visit 148.50 as long as the price is stable below 161.60.

Stability above 161.60 increases the possibility of retesting 162.00/161.90 before resuming the bearish attempts.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations