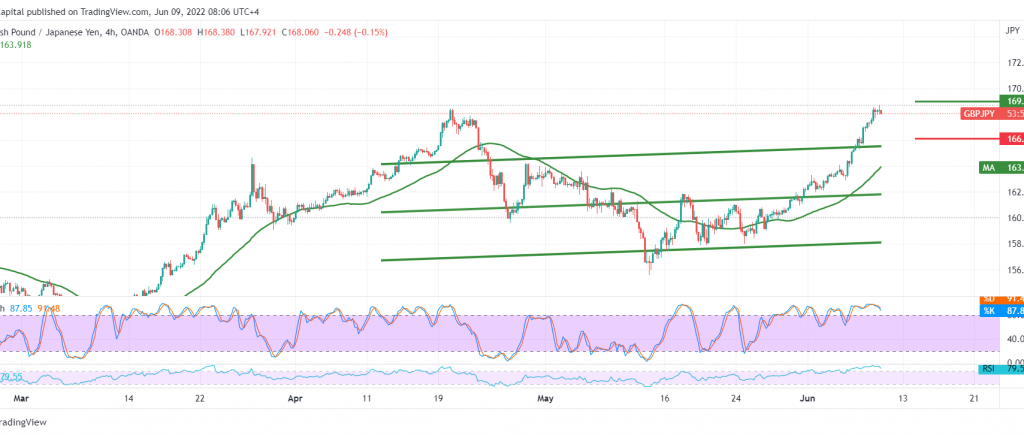

GBP/JPY touched all the ascending targets published during the previous analysis, reaching the official target station in the last report at the price of 168.80, recording its highest level of 168.75.

On the technical side today, and by looking at the hourly chart, the overbought signs started appearing on the pair clearly, beginning to lose the bullish momentum on the short time frames gradually.

Therefore, with intraday trading remaining below 168.50, and most importantly 169.00, we may witness a bearish bias in the coming hours, whose goal is to retest 167.00 first target. The decline below the mentioned level extends the idea of retesting towards 166.50 as long as the price is generally stable below 169.00.

Note: the expected bearish bias during the coming hours does not contradict the general bullish trend, which targets around 169.70 and 170.70 once the breach of 169.00 is confirmed and settled above it.

Note: ECB monetary policy statement and press conference are due today and may cause some volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations