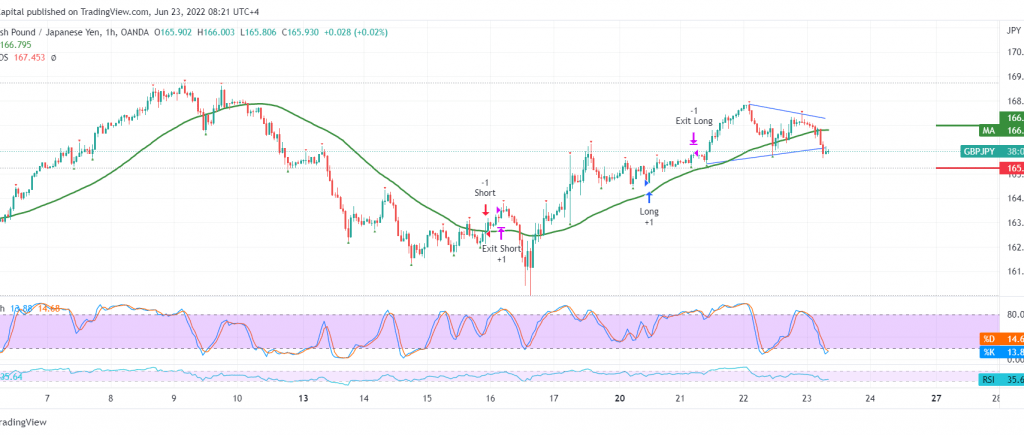

Noticeable negative trades dominated the movements of GBP/JPY within the idea of the expected bearish tendency during the previous analysis, approaching by a few points the required target of 165.50, recording its lowest level during the early trading of the current session, 165.62.

Technically, we find the simple moving averages continuing their negative pressure on the price from the top. This comes in conjunction with the price stability below the resistance level of 166.80.

Therefore, the continuation of the decline is still valid and practical, with a target of 165.10, a next target that may extend later towards 164.30 unless we witness any trading above 166.80.

Consolidation above 166.80 leads the pair to attempt to recover to retest 167.30.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations