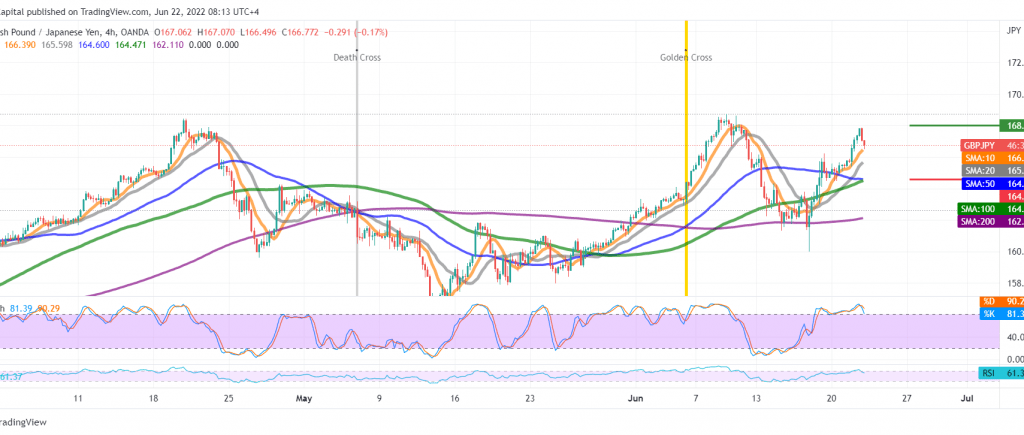

GBP/JPY was able to record noticeable gains within the expected bullish path during the previous analysis, touching the official target station of 167.00 and approaching by a few points from the second target of 168.00, recording its highest level at 167.85.

Technically, the pair’s intraday movements are witnessing a bearish tendency due to stochastic gradually losing the bullish momentum, in addition to the stability of the intraday trading below 167.80.

Therefore, the possibility of a slight bearish bias in the coming hours may be valid and effective, targeting 165.50, knowing that breaking it opens the door to visit 164.30, as long as the price is stable below 168.00.

Note: the bearish bias does not contradict the general bullish trend, which targets around 169.10 and 170.00 once the breach of 168.00 is confirmed.

Note: The testimony of “Jerome Powell” Chairman of the Federal Reserve is due today, and we may witness high volatility.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations