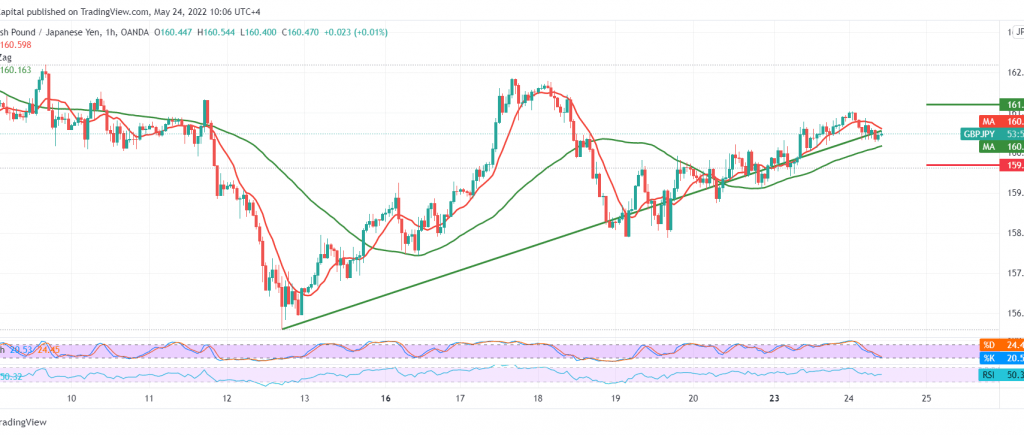

Mixed trading continues to dominate the pound’s movements against its Japanese counterpart, with the opening of this week’s trading failing to stabilize for a long time above the 161.00 level.

On the technical side, we are inclined in our trading to the negative, relying on the clear negative signs on the stochastic indicator and the intraday stability below the extended resistance level 161.20/161.00.

Therefore, there may be a possibility of a bearish bias in the coming hours, knowing that trading and stability below 160.20 facilitates the task required to visit 159.60, a first target that may extend later towards 158.70 as long as the price is stable below 161.20.

Consolidating above 161.20 will postpone the chances of a decline and lead the pair to recover to visit the first ascending target 161.90.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations