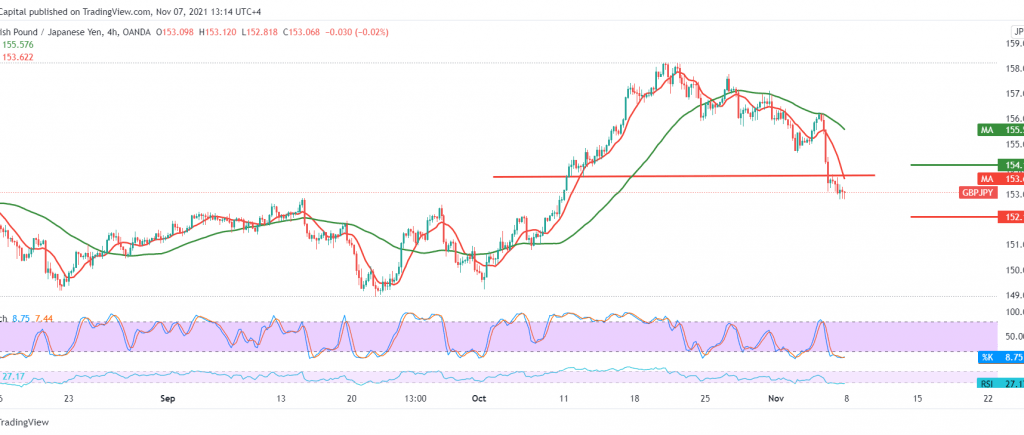

Negative trades dominated GBP/JPY, touching the first target mentioned in the last analysis at 152.80.

On the technical side, we are inclined in our trading to the negativity, relying on the continuation of the negative pressure coming from the 50-day moving average, which continues the negative pressure on the price from above and the clear negative signs of the stochastic indicator.

Therefore, the bearish scenario will be valid, targeting 152.50, considering that breaking the mentioned level will extend the pair’s losses so that we will be waiting for 152.10/152.0 as the next station.

Activating the suggested bearish scenario requires trading to remain below the 153.65 resistance level. Its breach will negate the suggested scenario and lead the pair to a temporary ascending path, targeting 154.20 before retracing.

| S1: 152.60 | R1: 153.65 |

| S2: 152.20 | R2: 154.20 |

| S3: 151.60 | R3: 154.65 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations