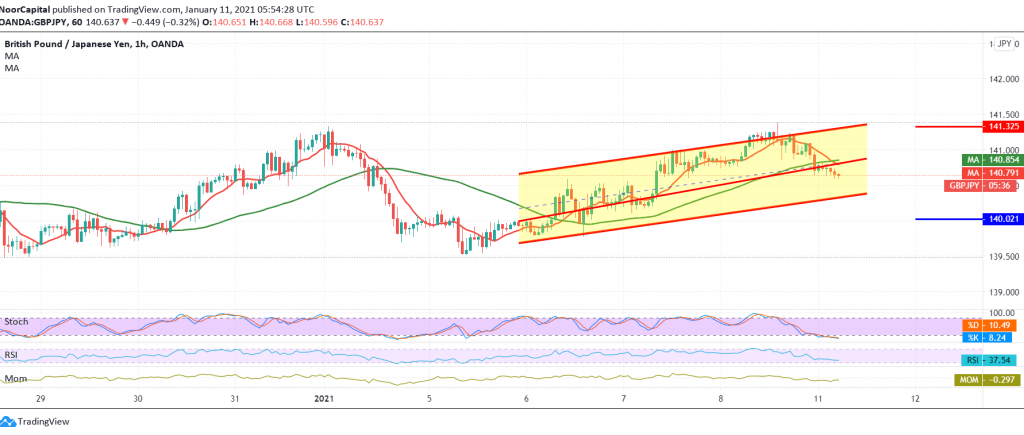

The current moves of the British pound against its Japanese counterpart are seeing a bearish bias on short time frames after failing to hold a long term above 141.00.

The technical side today indicates the possibility of a bearish bias during the coming hours, as a result of the clear negative signs on the stochastic indicator, in addition to trading stability below 141.30.

We target 140.35 as a first target, knowing that breaking it puts the price under negative pressure, the next target will be around 140.00 and may extend later towards 139.60.

Trading again above 141.20 is able to negate the suggested scenario, leading the pair to resume the rise with the target of 141.70.

| S1: 140.35 | R1: 141.20 |

| S2: 140.00 | R2: 141.70 |

| S3: 139.55 | R3: 142.20 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations