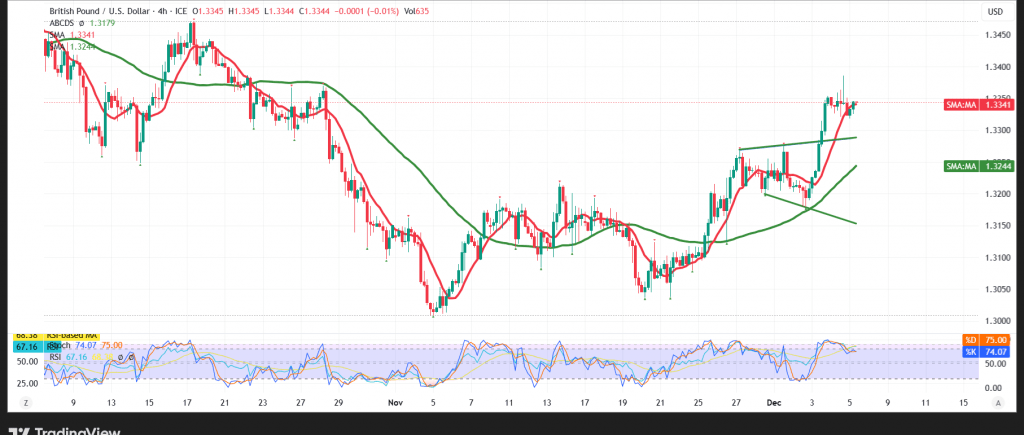

The British pound (GBP/USD) recorded a notable surge, posting strong gains yesterday near 1.3390.

Technical Outlook – 4-Hour Timeframe:

Simple moving averages continue to provide positive momentum, reinforcing the ongoing upward movement, supported further by positive divergence signals on the Relative Strength Index (RSI).

As long as daily trading holds above the 1.3300 support level, the upward bias remains more likely today, with targets at 1.3375 followed by 1.3410.

Conversely, a confirmed break below 1.3300 could place the pair under pressure, opening the door for a retest of 1.3290.

Warning: Today we await highly significant economic data releases from the U.S. economy, including the core Personal Consumption Expenditures (PCE) price index (monthly and annually) and the preliminary Michigan consumer sentiment index. High price volatility may occur around the release.

Warning: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3315 | R1: 1.3375 |

| S2: 1.3290 | R2: 1.3410 |

| S3: 1.3255 | R3: 1.3440 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations