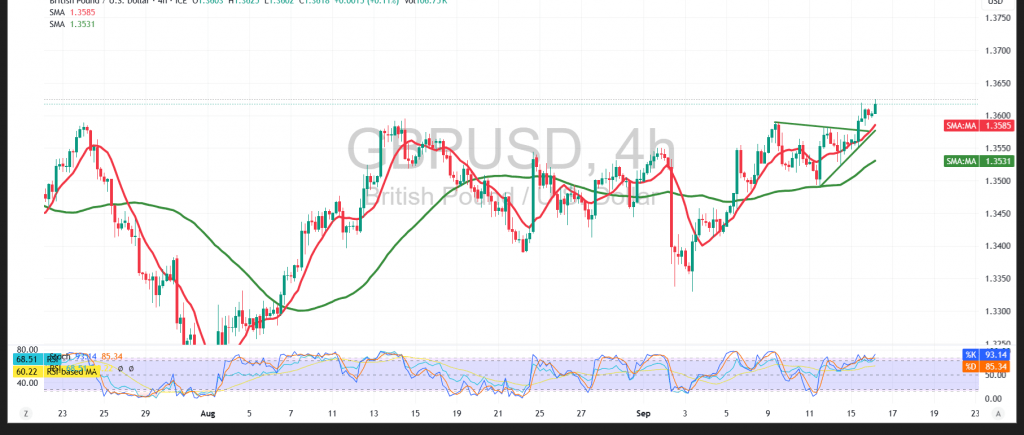

The GBP/USD pair posted notable gains in the previous session, reaching 1.3625 before easing into a minor correction after the recent advance.

Technical Outlook – 4-hour timeframe:

- Relative Strength Index (RSI): The indicator has begun issuing negative signals, suggesting a potential short-term weakening in buying momentum.

- 50-period Simple Moving Average (SMA): Price action remains supported above this level, reinforcing the likelihood of the broader uptrend continuing in the near term.

Likely Scenario:

The 1.3570 level remains pivotal for sustaining the bullish outlook. A confirmed break above the 1.3645 resistance could clear the path for further intraday gains toward 1.3675, with scope to extend higher toward 1.3710.

Conversely:

A decisive break below 1.3570 would revive bearish bias, exposing the pair to deeper pullbacks toward the next support zones near 1.3520.

Fundamental Note:

Today’s session features high-impact U.S. economic data (retail sales) alongside Canada’s Consumer Price Index (CPI) (annual and monthly). These releases may trigger heightened price volatility.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3570 | R1: 1.3645 |

| S2: 1.3520 | R2: 1.3675 |

| S3: 1.3485 | R3: 1.3720 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations