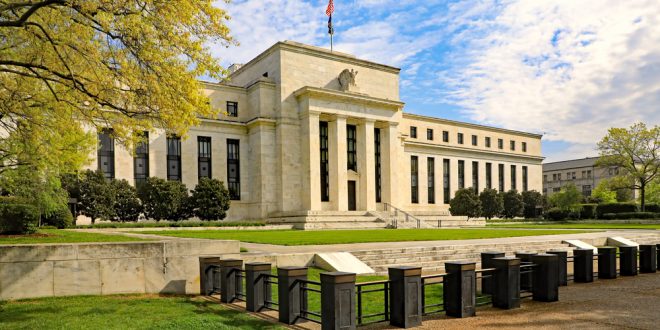

The U. S. Fed released its minutes of the September monetary policy meeting. Participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate.

Various participants stressed that economic conditions were likely to justify keeping the rate at or near its lower bound over the next two years.

Fed noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.

Participants cited upside risks that inflation would continue for longer than expected, especially if labour and other supply shortages proved more persistent than currently anticipated.

Several participants indicated that a rise in the labour force participation rate might lag the improvements in other indicators such as the unemployment rate – a pattern consistent with past business cycle recoveries.

A number of others assessed that once the covid-related concerns that were currently weighing on labour force participation passed, the participation rate and the EPOP ratio could return to, or even exceed the pre-pandemic levels.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations