The second week of October trading began with optimism in North American equity markets despite increased Middle East tensions, ongoing war in Ukraine, a stronger than expected American economy, and weaker than expected numbers from China.

China:

The National Development & Reform Commission (NDRC), China’s state planner, stated that the downward pressure on China’s economy is increasing, adding that China’s economy is facing more complex internal and external environments. Growing concerns over an economic downturn in China, the world’s biggest consumer of Gold, caused the precious metal to continue to stretch lower. China’s Shanghai Composite Index fell nearly 7%, and Hong Kong’s Hang Seng Index lost over 1% on Wednesday.

Stock Markets

The US and Canadian stock markets experienced higher performance on Friday, with the S&P 500 and Canadian TSX outperforming the technology-heavy Nasdaq. Sector leadership was driven by financials, which benefited from strong earnings reports from big banks like JPMorgan and Wells Fargo. Financials and industrials were the best-performing sectors in the S&P 500, while lagging sectors included technology and consumer discretionary. This broadening of market leadership likely has legs, especially as the Federal Reserve continues its rate-cutting cycle and as earnings growth is driven by both tech and non-tech parts of the market.

Inflation Data, Investor Sentiment

US producer price index (PPI) inflation data for August was in line with expectations, with headline PPI being flat month-over-month and core PPI up 0.2% month-over-month. Services inflation was the primary driver, while goods inflation decreased by 0.2%. Energy and gasoline prices were a large contributor to the decline in prices.

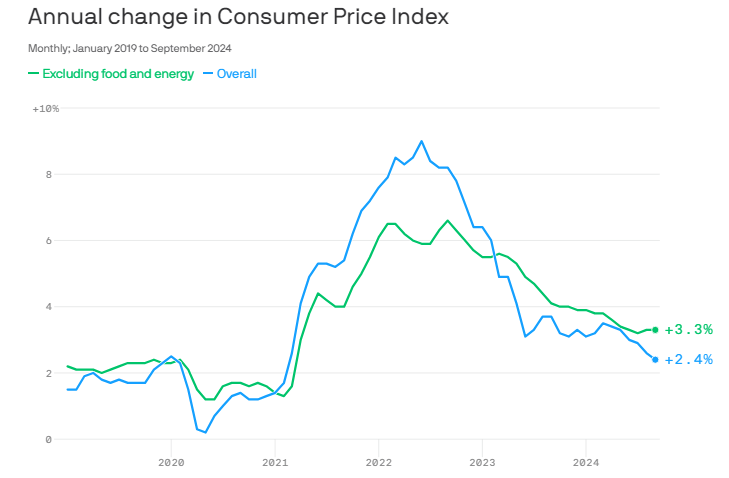

With CPI inflation now at 2.4% year-over-year, the last mile to the Fed’s 2.0% target may be bumpy, but there are drivers that will likely support a gradual move lower, including lower wage gains over time, which should support lower services inflation, and an eventual move lower in the shelter and rent components of the basket.

Q3 earnings season

Q3 earnings season kicked off on a strong note, with big banks such as JPMorgan and Wells Fargo reporting earnings. JPMorgan noted that consumers are “fine and on strong footing,” while Wells Fargo topped analyst forecasts and noted a more diverse set of revenue streams that offset a decrease in net interest income.

Volatility Persists

The markets have come through the first week of a usually volatile October largely intact and climbing a very tall wall of worry. Later in the week, the NASDAQ Exchange closed at a new 3-month high of 18,343, and the TSX Venture Exchange reached a new 5-month closing high of 605. The CBOE Volatility Index or VIX rose 6.51% to 20.46. For the Week – the DJI gained 1.21% to 42,864, with the S&P 500 up 1.17% to 5,815, and the NASDAQ rose 1.13% to 18,343. Across the line – the TSX rose 1.27% to 24,471 and the TSX Venture gained 1.68% to 605. The CBOE Volatility Index or VIX rose 6.51% to 20.46.

Currencies:

The Canadian dollar fell 1.34% to US$0.7266, while the US dollar ‘DXY’ rose 0.42% to 102.92. The US Dollar generally experienced a positive week, with short-term yields remaining steady near multi-week highs, while mid- and long-term segments showed strong recovery. The US Dollar Index (DXY) tested the 103.00 level for the first time since mid-August, continuing its climb from recent lows around the key psychological 100.00 region and the 200-week Simple Moving Average (SMA) around 100.60. The Dollar’s strength persisted despite the Federal Reserve’s unexpected half-point rate cut on September 18. A resilient US economy, gradual cooling of the labor market, and rising expectations of a 25 basis point (bps) instead of a 50 bps rate cut next month have supported further gains for the Greenback.

Looking forward, the Dollar’s price action suggests firm support around the 100.00 psychological level, while the next major upside target is the 200-day Simple Moving Average (SMA), currently at 103.75. Safe-haven demand continued to bolster the Greenback, as global markets turned to risk aversion following Iran’s missile strike on Israel in early October. This escalation led to a spike in market volatility, with the VIX index (the “panic index”) rising above 23, reaching levels unseen since September. The heightened demand for safer assets provided additional support for the already-strong Dollar, while simultaneously weighing heavily on the risk-sensitive universe.

Following the unexpected 50 basis point rate cut in September, market participants have turned their attention to the performance of the US economy to gauge the likelihood of further reductions. This focus aligns with the Federal Reserve’s shift toward monitoring the labour market, although inflation, especially excluding food and energy costs, has been proving more stubborn than previously thought. Fed Chair Jerome Powell noted that the US economy appears to be on track for further declines in inflation, which could give the central bank room to lower its benchmark interest rate further and eventually reach a neutral level that supports economic growth.

Federal Reserve officials expressed a range of views regarding future interest rate cuts during the week, although the majority appear to lean towards a quarter percentage point reduction next month. Some policymakers support additional rate cuts depending on economic conditions, highlighting that future policy decisions would be data-driven. The CME Group’s FedWatch Tool now predicts around 82% likelihood of a 25 basis point rate cut at the November 7 event, a significant increase from the nearly 50% probability estimated just a month ago.

Commodities:

Gold gained 0.15% to US$2,657, while silver lost 2.02% to US$31.53, and copper fell 1.55% to US$4.45, as lithium rose 1.72% to US$10,824. Crude oil gained 1.41% to US$75.50, while natural gas dropped 7.07% to US$2.63, and uranium rose 1.58% to US$83.50. With soft commodities – lumber gained 0.38% to US$526. Overall – the CRB Commodities Index was unchanged at 346.

Gold continued to stretch higher on Friday but struggled to gather bullish momentum. The final data of the week from the US showed that the Producer Price Index (PPI) rose 1.8% on a yearly basis in September, arriving above the market forecast of 1.6%. Gold investors will continue to scrutinize macroeconomic data releases from China next week, with disappointing data releases likely to hurt Gold, while positive surprises could be supportive for the yellow metal.

Gold (XAU/USD) experienced a sharp decline in the first half of the week, but regained its momentum after coming within a touching distance of $2,600. The positive impact of the previous Friday’s upbeat September employment data continued to be felt on the USD, while geopolitical tensions remain high amid continued Israeli-Iranian threats, causing XAU/USD to stay on the back foot.

FOMC Minutes:

The hawkish tone in the minutes of the Federal Reserve’s September policy meeting helped the US Dollar (USD) outperform its rivals late Wednesday, not allowing XAU/USD to stage a rebound. The US Bureau of Labor Statistics reported that annual inflation in the US softened to 2.4% in September from 2.5% in August, with the core CPI rising 3.3% on a yearly basis. The disappointing Initial Jobless Claims reading did not allow the USD to benefit from the inflation report and helped XAU/USD find its footing.

What’s up next week?

Monday, October 14, is not a stock market holiday, but the bond market is closed in observance of Columbus Day/Indigenous Peoples’ Day. There are no noteworthy earnings reports scheduled.

The upcoming US economic calendar will highlight Retail Sales and the weekly Initial Jobless Claims as key data releases in what seems to be a week initially overshadowed by the European Central Bank’s (ECB) interest rate decision on Thursday.

Additionally, market participants will be closely monitoring speeches from several Federal Reserve officials, with primary attention focused on the potential direction of the Fed’s interest rate policy.

Oil Prices Surge Amid Rising Tensions

Oil prices experienced a significant uptick during the second week of October, driven primarily by escalating tensions between Iran and Israel. The threat of Israeli retaliation against Iran’s missile attack on Israeli targets sparked concerns about potential disruptions to Middle Eastern oil supplies, bolstering crude oil prices.

Key Developments:

- Israeli Retaliation Concerns: The anticipation of Israel’s response to Iran’s missile attack fueled fears of a potential escalation in the region, leading to a surge in oil prices.

- Price Gains: Both the US benchmark (WTI) and the global benchmark (Brent) crude oil prices recorded gains of over 1% for the week.

- Geopolitical Premium: The heightened geopolitical tensions added a “war premium” to oil prices, contributing to the significant price increase.

- Rig Count Stability: The US rig count remained relatively stable, with a slight increase in the number of rigs exploring for oil.

Market Outlook:

While the immediate price surge was driven by geopolitical factors, sustaining bullish momentum in the oil market may prove challenging without additional catalysts. The “war premium” and “stimulus premium” are susceptible to fading if tensions de-escalate or if economic conditions deteriorate.

Price Movements:

- West Texas Intermediate (WTI): $75.56 per barrel, down 29 cents from the previous week.

- Brent Crude: $79.04 per barrel, down 36 cents from the previous week.

- RBOB Gasoline: $2.1516 per gallon, little changed.

- Natural Gas: $2.632 per gallon, down 1.61%.

The oil market experienced a significant uptick during the week due to heightened geopolitical tensions between Iran and Israel. While the short-term outlook remains uncertain, the potential for further escalation in the region could continue to support higher oil prices. Investors will closely monitor developments in the Middle East and economic indicators for clues about the future trajectory of oil prices.

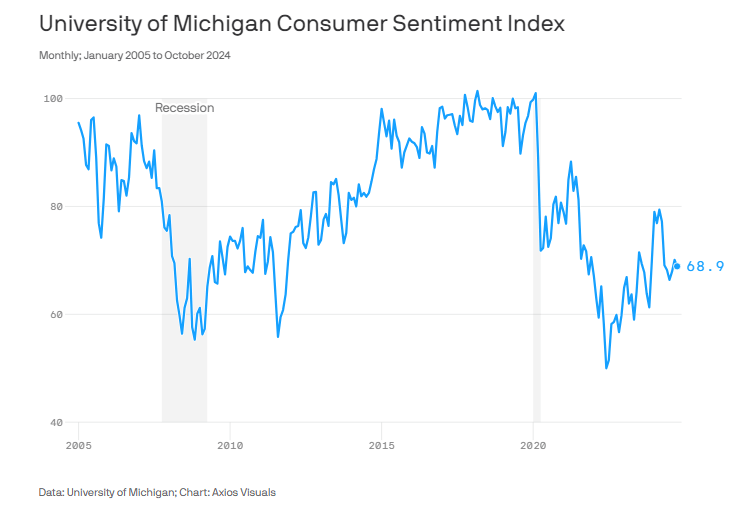

Following two months of increases, the Michigan Consumer Sentiment Index slightly declined in October (within the error margin). The level of sentiment has increased by 8% from a year ago and is about 40% higher than the June 2022 low.

Consumers continue to express frustration over high prices, even though inflation expectations have eased substantially. 59% of American adults believe the economy is getting worse, which is more than twice as many as those who say it’s improving, 23%. An alert indicating that consumers’ concerns over the expense of living are still present. Halloween sales are expected to be 5% less than the record-breaking amount of last year, with greeting cards.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations